The Internal Revenue Service (IRS) confirmed that it accidentally exposed the confidential data of about 120,000 individuals on its website. The information has since been removed.

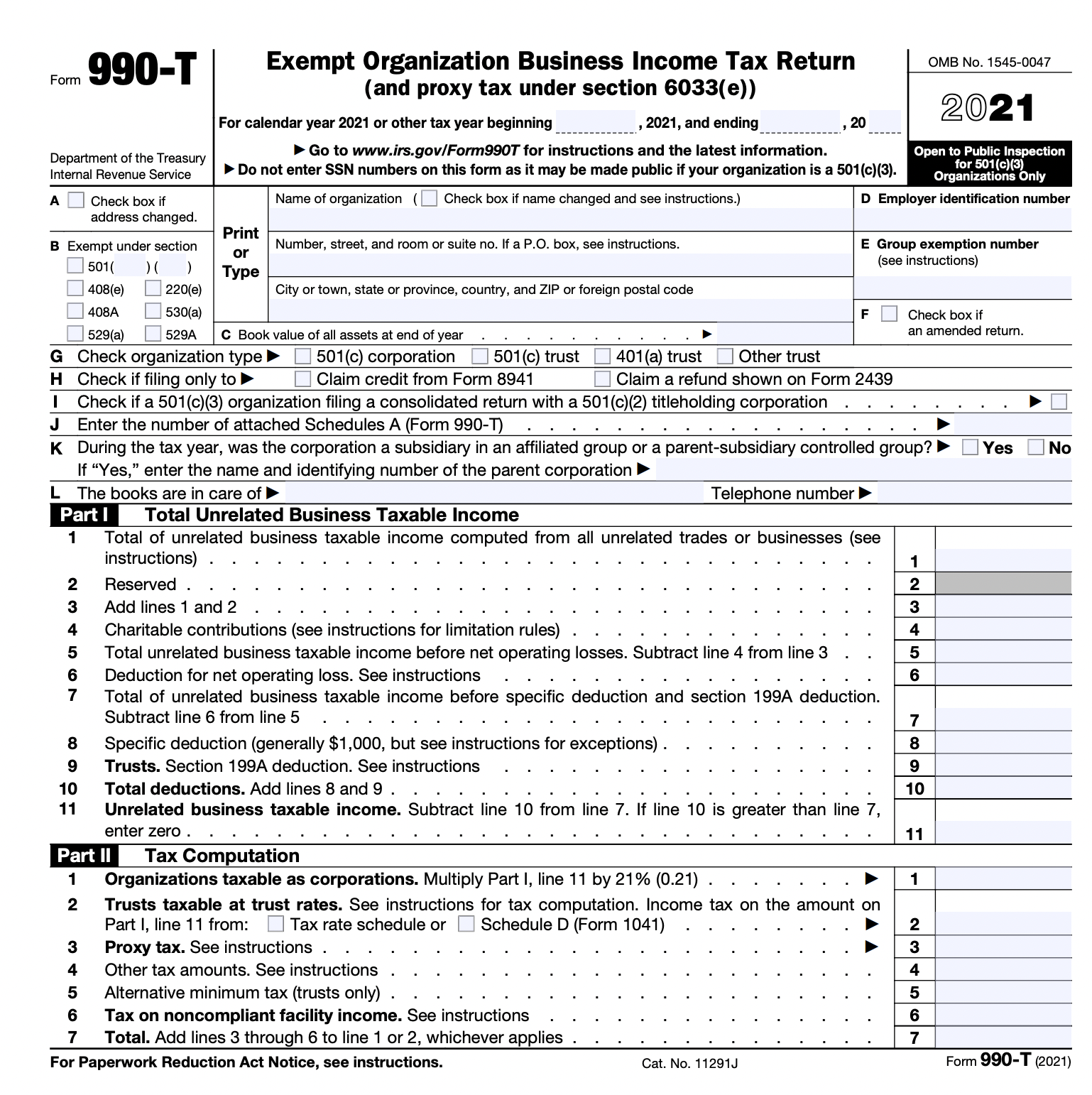

The data exposed was from Form 990-T, filed by individuals with individual retirement accounts (IRAs) who earn some type of business income, aside from securities, from their retirement plans.

Individual tax filings are supposed to be private. However, charities with unrelated business income also file Form 990-T and their filings are usually made public.

The Treasury Department and IRS said a human coding error was responsible for the confidential data exposure. The error resulted in both confidential and public data being posted on the IRS’s website. It was available for searching and downloading, according to the Wall Street Journal.

In a letter to Congress on Friday, the Treasury Department said that the data that was exposed was names, contacts, and financial data related to the income earned through the IRAs. Full individual income, Social Security numbers, and other information that could harm a taxpayer’s credit was not exposed.