This game might already be systemically rigged beyond repair: we’ve seen it before with accusations that Google has been on a consistent mission to eradicate competition by giving obvious preference to its own products and services in what is for many users, and businesses, a be-all and end-all: the Google search results.

This has led many – including the EU – to accuse the giant of abusing its dominant position to skew the market in its favor in an unfair way. Google, of course, consistently denied this.

And now the same serious concerns are begin voiced about another trillion-dollar tech company, Amazon.

An independent investigation examines this in quite a bit of detail.

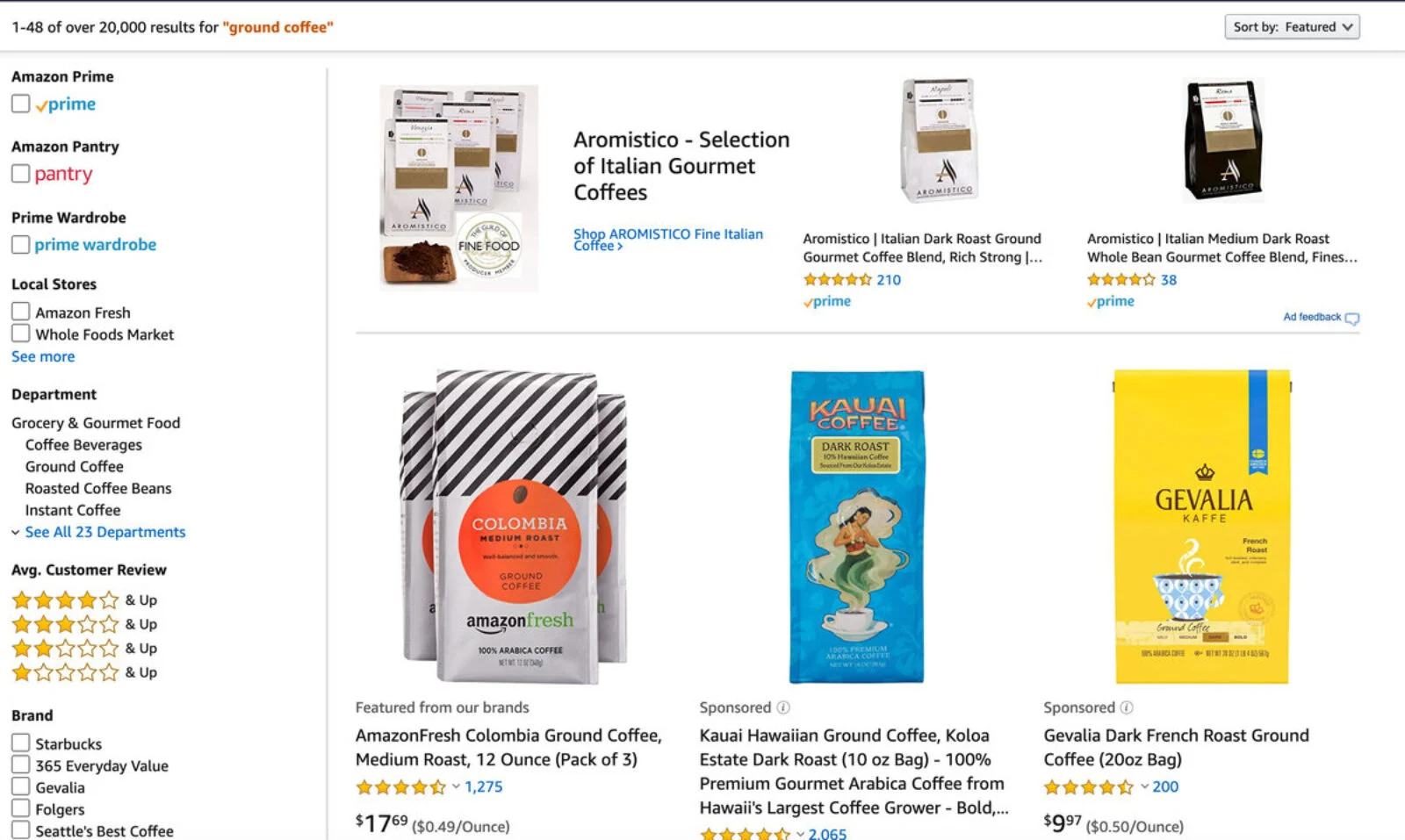

The report goes into how this behemoth reportedly squeezes smaller companies and brands from the most visible and therefore lucrative places in its search results.

Not to put too fine a point on it: that means that small, or even medium-sized businesses, in this scenario, end up comprehensively screwed.

In Amazon’s case, what those sellers are noticing is that the giant has – just like that – started replacing theirs with a range of its own products in “the most coveted real estate on the listings results — top left on the first page” – for what used to be reserved for those who managed to outbid competitors for the best spots. (And that was in exchange for paying their money dues to Amazon.)

But now these rules seem to be thrown out the window.

“This is madness,” said consultant Jason Boyce, who represents a number of clients, who, to make this story go from bad to worse, apparently also “fear Amazon’s retaliation.”

“They were thinking, ‘What is Amazon going to do next?,” Boyce is quoted as saying.

But what is Amazon thinking?

“Amazon’s private brand products have on average higher customer review ratings, lower return rates and higher repeat purchase rates than other comparable brands in the Amazon store,” a spokesperson said.

Now – getting from bad to worse, to even worse – the story reveals that Amazon’s own algorithms don’t necessarily justify its favoritism of private label brands.

One of the people quoted in the report is James Thomson, a former head of an Amazon team recruiting third-party sellers – and this is what he had to say: “(Amazon) confuses consumers into thinking these products are more popular than they really are.”

But Amazon said that sales is only one of many factors considered by its algorithm.

Meanwhile, fellow giants, like Unilever, aren’t nearly as perplexed by any of this, the report – surprising nobody – reveals.