The news that de-banking is very much a real phenomenon, documented on both sides of the Atlantic, apparently has not reached the legacy media in the US.

Either that or they are deliberately ignoring it. The reason could be that de-banking – the policy of denying financial services to individuals or companies because of their political views – became visible during the Biden administration, as it affected some high-profile figures.

Prompted by President Trump bringing up the issue last Thursday, straight to the face of the elites gathered in Davos, including financial ones, when he spoke about major banks debanking conservative customers – the likes of MSNBC and the Financial Times decided to gaslight their audience into believing that the remarks were “crazy,” “bonkers,” and variations thereof.

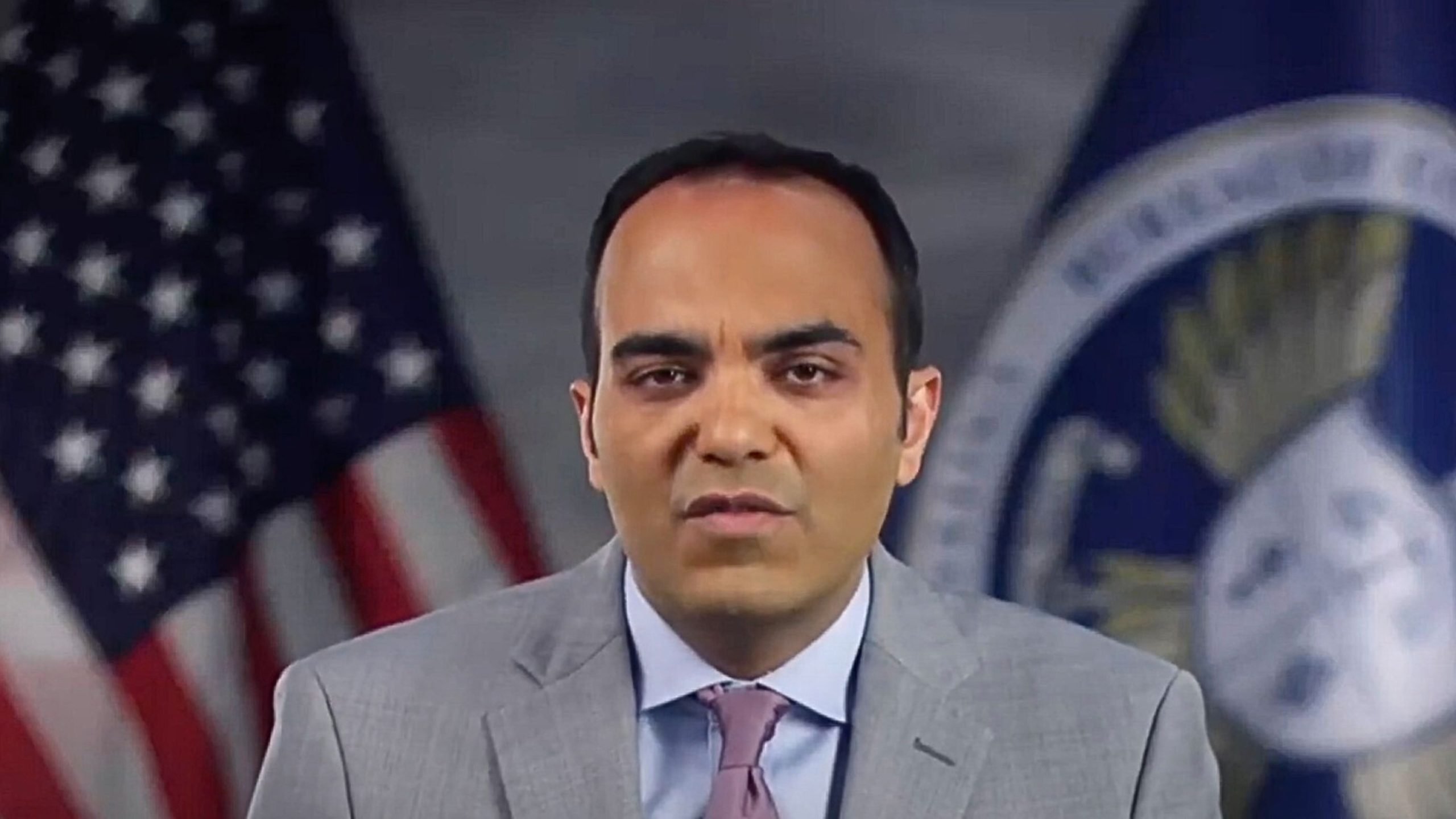

But then, none other than Rohit Chopra, the head of the Consumer Financial Protection Bureau (CFPB) and a Biden appointee, went on CNBC to give credence to Trump’s comments.

According to NewsBusters, shortly before that, MSNBC’s Stephanie Ruhle asked, “What in the world is he (Trump) talking about?!,” Chopra’s words might shed some light.

“When the CFPB put into place a policy view that banks should not be de-banking based on certain characteristics, they sued us for that,” he said, the reference to “certain characteristics” pertaining to political or religious views.

When a co-host said that the banks are denying they engage in de-banking of this type, Chopra wondered, “So why have they been so resistant, then, to some of the rules that make that absolutely clear?… I would certainly hope that they are not using any of those criteria at all, but it is important that the regulators make sure of that.”

US legislators feel the same. A House Committee on Oversight and Government Reform investigation is now underway to determine if American individuals and businesses have indeed been exposed to de-banking because of their political affiliation.

One of those who previously spoke about this is venture capitalist Marc Andreessen, who told Joe Rogan that more than two dozen tech founders got de-banking during the previous four years – because of their politics.

There are also reports going back to the Covid era of individuals and organizations being denied financial services because they failed to toe the official line on lockdowns and other restrictions.

Some of the prominent figures that in the past accused banks of discriminating against them or family members by means of de-banking are First Lady Melania Trump, and Nigel Farage in the UK.