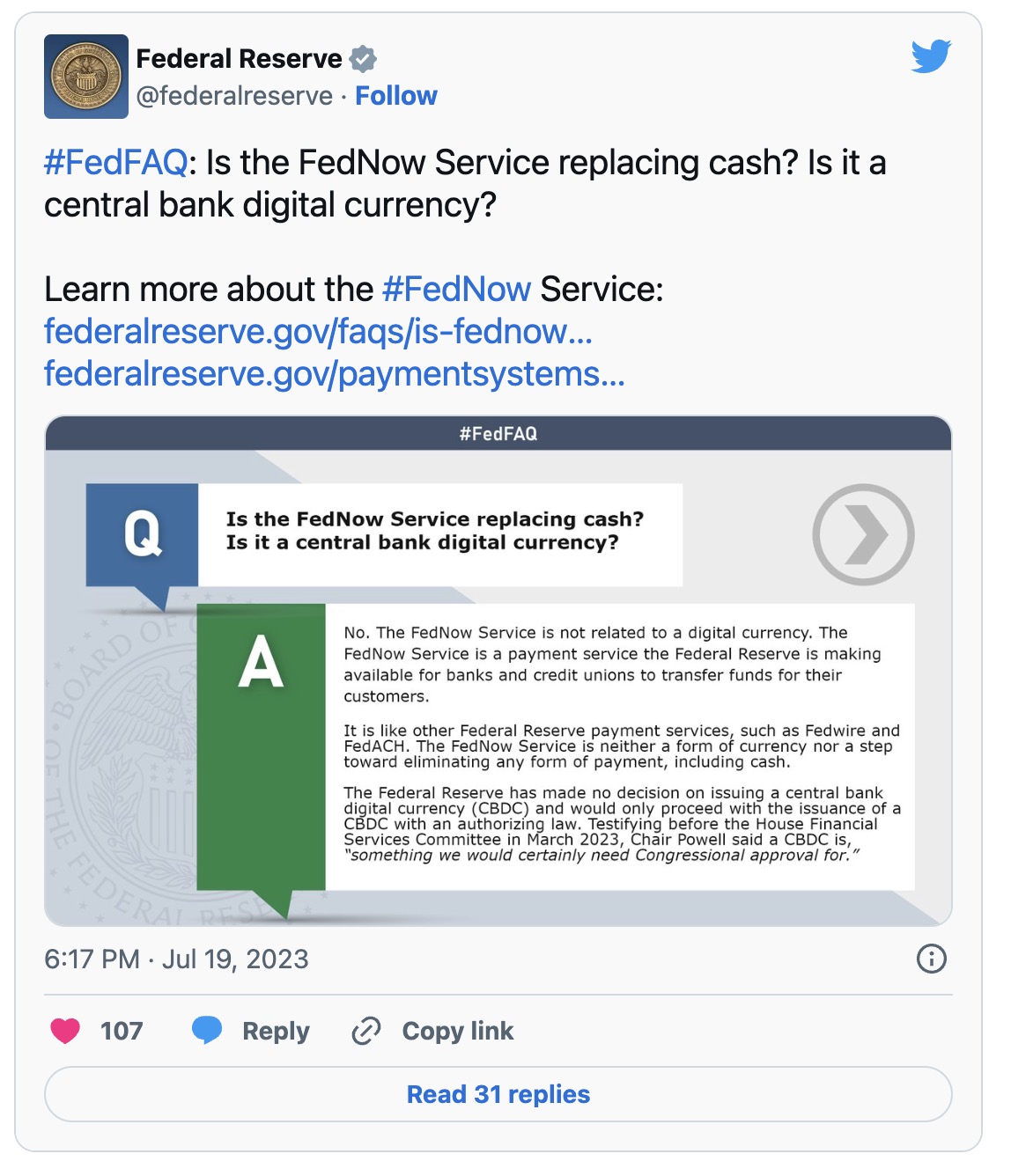

The Federal Reserve has asserted that the FedNow Service, its latest instant payment offering for organizations, is unrelated to the concept of central bank digital currencies (CBDCs). The new service is expected to revolutionize the payment landscape by offering real-time gross settlement (RTGS), a departure from traditional methods, which can take up to a few days.

Yet, while FedNow isn’t a CBDC and isn’t yet tied to one, it certainly makes implementing a future CBDC much easier – and that’s why critics are skeptical.

The central bank has brought on board a mix of 41 financial institutions, 15 service providers, and the US Department of the Treasury to fine-tune the FedNow Service before its roll-out slated for late July 2023.

As expressed on social media, the Federal Reserve likened FedNow to existing payment services such as Fedwire and FedACH, indicating that they all operate within the fiat currency framework. In its statement, the Federal Reserve highlighted that “The FedNow Service is a payment service the Federal Reserve is making available for banks and credit unions to transfer funds for their customers” and emphasized its non-association with digital currencies. The lady doth protest too much methinks.

Amidst speculation around the launch of a CBDC, the Federal Reserve reasserted its stance, stating it has yet to decide on the issuance of a CBDC and would only consider such a move if sanctioned by law.

Though a comprehensive list of initial participants is already in place, the Federal Reserve has a forward-looking plan to include all 10,000 US financial institutions in the system eventually.

FedNow Service aims to address the latency issues in traditional payment methods such as check, Automated Clearing House (ACH) transactions, and debit card processing. The new service will allow for round-the-clock, instant transfer of money, thereby fostering an efficient financial ecosystem.

However, it’s important to note that FedNow is essentially the network — or as the Federal Reserve describes, the “high-speed highway”— that enables swift payments. The 9,000 banks and credit unions across the nation have to make a choice to be a part of this network and subsequently develop mobile apps or websites for their customers to send and receive money instantly.

Contrary to payment platforms such as PayPal, Venmo, and Zelle, which require funds to be transferred within their system or face delays in bank account transactions, the FedNow Service could enable immediate fund transfers. This development could facilitate scenarios like paying for a cab ride without a wallet, simply using a mobile phone and an app.