State lawmakers in Florida have introduced bills that would ban the use of federal and foreign CBDCs. In March, Gov. Ron DeSantis called on lawmakers to introduce such legislation to prevent the abuse of CBDCs to control or surveil people.

Senate Bill 7054 and the related House Bill 7049 would amend the definition of money and introduce the definition of a CBDC under the US Uniform Commercial Code (UCC), which is adopted as state law.

The bills would prevent the use of digital currencies backed by governments but allow the use of cryptocurrencies like Bitcoin, which are decentralized.

Related: Biden signals plan to destroy financial anonymity with CBDCs

The bills define a CBDC as a digital currency, digital monetary unit, or digital medium of exchange issued by the US Federal Reserve, federal agency, foreign central bank or reserve, or foreign government made directly available to consumers and directly processed or validated by said entities.

An analysis of SB 7054 on the Florida Senate’s website notes that 11 countries, including China, have fully implemented a CBDC while 18 others are piloting CBDC programs. In the US, a CBDC is in the development phase.

The introduction of both bills came after DeSantis called for legislation to prevent the use of CBDCs in the Sunshine State. He argued that the Biden administration was pushing for a digital currency to use as a tool to control and surveil people.

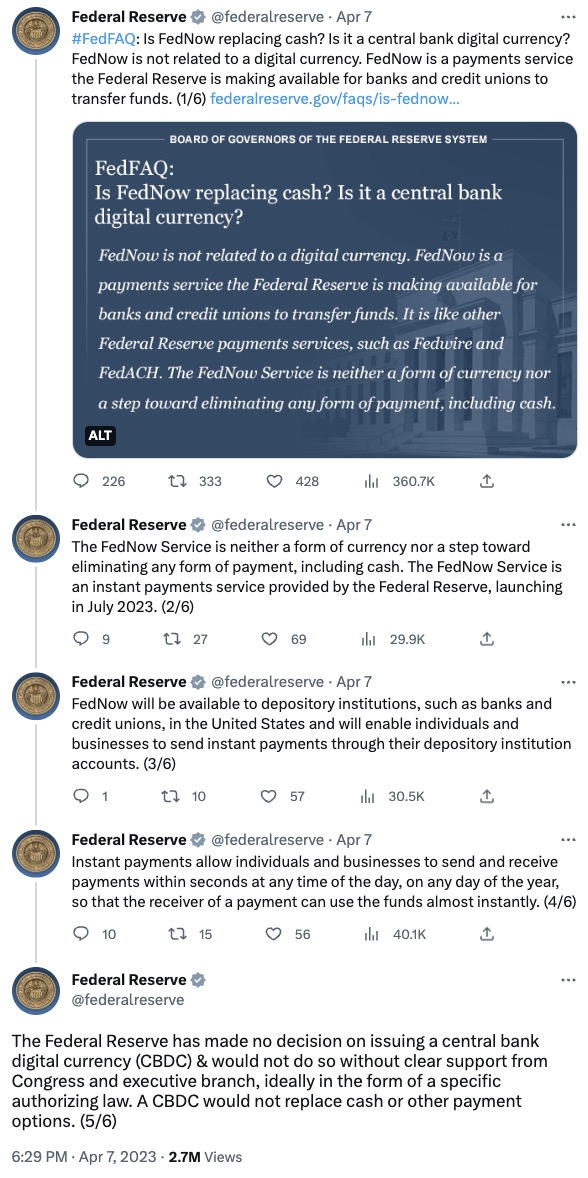

The US Federal Reserve recently tweeted that a central bank digital currency would not be issued without the approval of Congress and the president, “ideally in the form of a [law].”

Responding to the tweet, Florida’s Gov. Ron DeSantis said that people “are wise enough to know” that a CBDC would be abused.

“The Federal Reserve has made no decision on issuing a central bank digital currency (CBDC) & would not do so without clear support from Congress and executive branch, ideally in the form of a specific authorizing law,” the Federal Reserve said. “A CBDC would not replace cash or other payment options.”

Specifically, DeSantis took issue with the agency’s use of the term “ideally.”

“It is not merely ‘ideal’ that major changes in policy receive specific authorization from Congress; it is constitutionally required,” DeSantis said. “Unaccountable institutions cannot impose a CBDC on Americans. They will tell us that CBDC won’t be abused but we are wise enough to know better.”

“This wolf comes as a wolf.”

Last month, DeSantis called on Florida’s lawmakers to ban CBDCs in Florida.

“I am here to call on the legislature to pass legislation to expressly forbid the use of CBDC as money within Florida’s uniform commercial code,” he said at a press conference.

He suggested that the legislation would make sure that the state supports innovation in the financial sector “while protecting against government surveillance over your personal finances.”

The legislation would also ban CBDCs issued by central banks in other countries.

“This will ensure that any effort to adopt a worldwide digital currency will never occur in the Free State of Florida,” he said.

DeSantis encouraged other states to adopt similar legislation.

“I think it’s really important that states stand up to fight back against some of the things that are going on, or most of the things that are going on right now in Washington, because they don’t have your best interests at heart.

They have their own power at heart,” DeSantis said.