The US Securities and Exchange Commission (SEC) has delivered an enforcement notice to Uniswap, a decentralized cryptocurrency exchange.

Known as a Wells notice, the enforcement wrangle points toward a future legal dispute between the regulatory body and Uniswap, reflecting its reputation as a precursor to enforcement actions.

The enforcement notice is seen as a move against decentralized finance (DeFi) for several reasons. First, this action signifies increased regulatory scrutiny on DeFi platforms, which fundamentally operate on principles of decentralization and less regulatory oversight. The SEC’s focus on Uniswap, particularly on issues surrounding the classification of its native token UNI and its operation as a potential unregistered securities market, suggests an attempt to apply traditional financial regulatory frameworks to DeFi.

Related: An introduction to decentralized finance

DeFi platforms like Uniswap offer an alternative to traditional financial systems by enabling financial transactions without central intermediaries, using blockchain technology. This enforcement notice challenges the very nature of such platforms, potentially leading to stricter regulations that could limit their decentralized nature.

Uniswap’s leadership, viewing this as an attack on the broader DeFi space, indicates a perceived threat to the industry’s future, especially if tokens and platforms are subjected to traditional securities laws. This scenario could lead to increased compliance costs and operational changes for DeFi entities, impacting their decentralized and open nature. The situation illustrates a growing tension between the evolving DeFi sector and traditional regulatory frameworks, which could shape the future of blockchain-based financial systems.

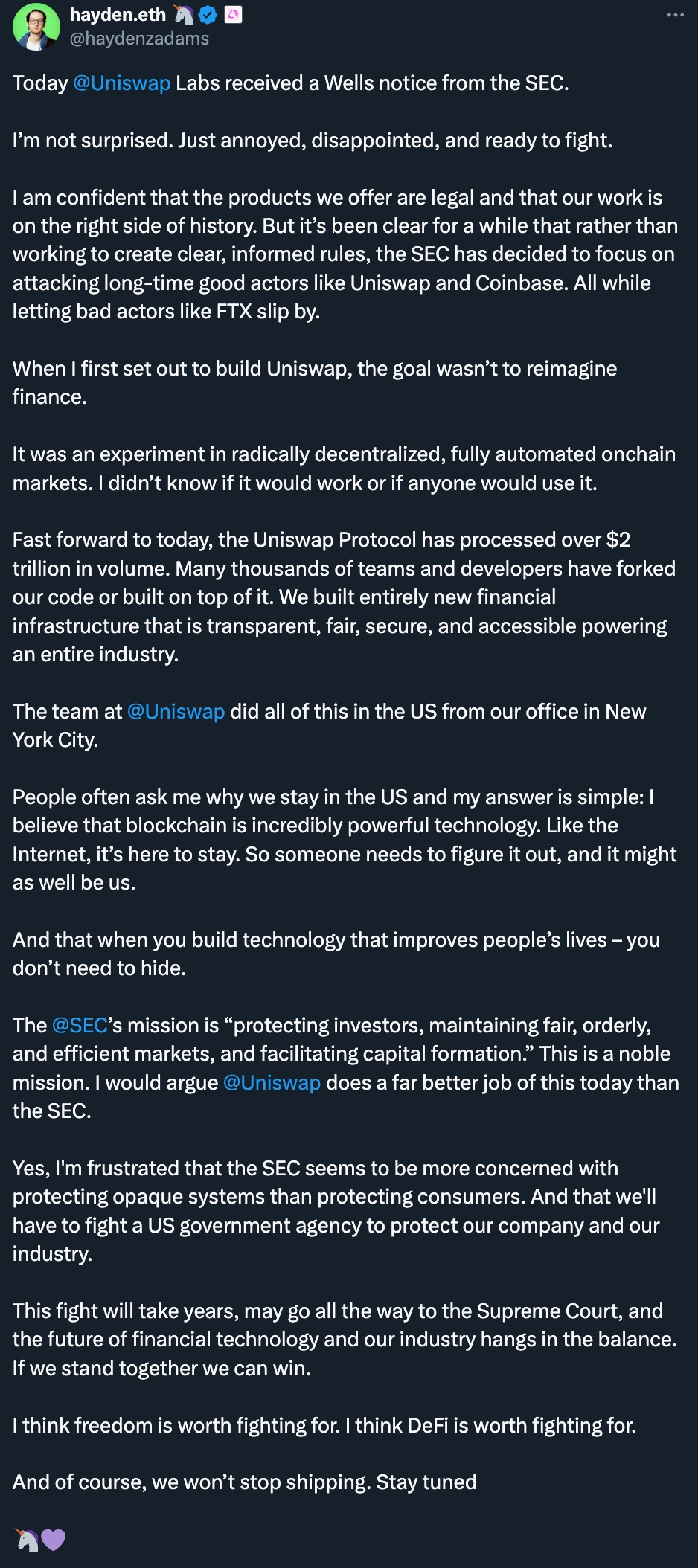

Hayden Adams, Uniswap’s CEO, publicly responded to the enforcement notice, illustrating his readiness to combat the SEC’s intent and expressing his disappointment and annoyance. The company’s Chief Legal Officer, Marvin Ammori, and COO Mary-Catherine Lader, reaffirmed this stance in a press briefing. They underscored that the SEC’s indications were pivoted around Uniswap operating as an unascertained securities agent and unregistered securities market, without certainty about whether UNI, Uniswap’s native token, was identified in the notice as a potential security.

Ammori confidently stated the belief that Uniswap can successfully combat the SEC’s charges based on a precedent set by the ruling in the SEC’s dispute with Coinbase. This ruling declared that Coinbase Wallet doesn’t fit the broker definition, which is a positive indicator of Uniswap’s potential for defending similar charges. He disputed the SEC’s categorization of Uniswap as an exchange, asserting that the entity diverges from the SEC’s current definition.

Adams was forthcoming about his contentious stance against the SEC, asserting his assuredness about the legality of Uniswap’s offerings and its alignment with positive progression.

If you're tired of censorship and dystopian threats against civil liberties, subscribe to Reclaim The Net.