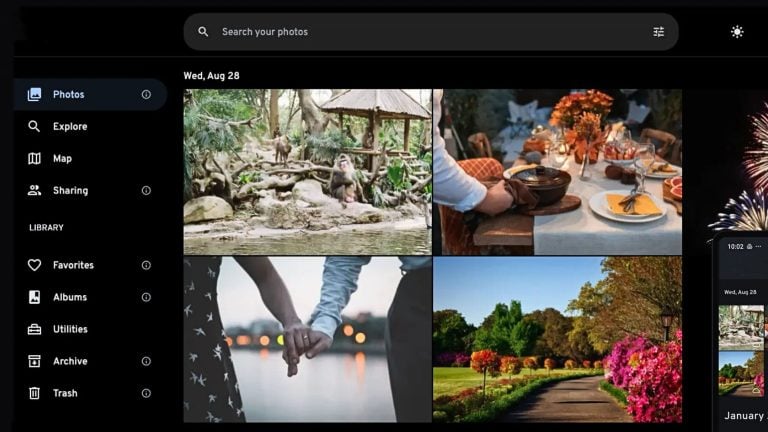

UK Finance chair Bob Wigley has predicted the development of a “super app” that would store a person’s economic digital identity, including credit score ratings and know-your-customer (KYC) data.

The economic digital ID would be similar to the UK government’s NHS health app, which carries an individual’s health data. Launched in January 2019, the app faced opposition before it gained popularity during the pandemic.

Finance expert Wigley says that the banking sector has taken note of the NHS app and might launch a similar app for economic data.

“This will be the year that we finally persuade the banking system that we need an economic digital identity system, just like the NHS app,” Wigley said at the New Digital Assets and Money Symposium in London.

“This financial app will be personal and attached to each citizen as we need a wider fully digital economic identity program.”

“It would be something each person would carry with them and they could then connect it to any platform or financial institution that they operate with, such as banks and insurance firms,” he explained.

Wigley added if the government does not do it, Big Tech platforms will.