Amazon and JPMorgan are involved in contributing to the push for CBDCs in Singapore.

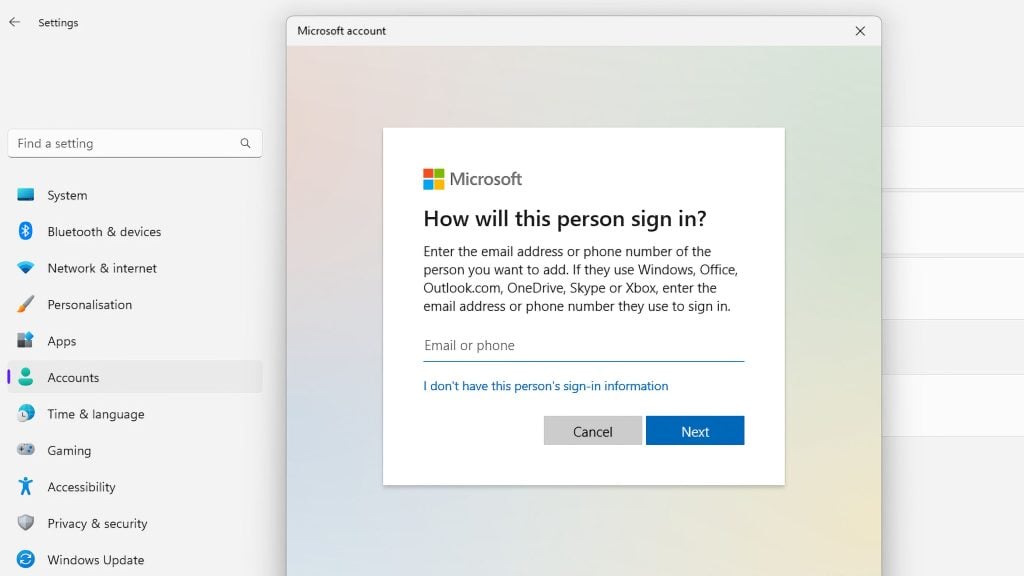

The Monetary Association of Singapore (MAS) has taken a leap into the controversial future of digital by publishing a paper outlining a protocol for digital money standards. This move is aimed at creating a uniform approach to the trade and transfer of digital assets, as well as creating a centralized system.

The paper is a collaborative effort, with contributions from global giants such as JPMorgan, Amazon, and the International Monetary Fund (IMF), as well as DBS Bank and the central banks of South Korea and Italy.

Digital currencies, which have been under the scanner of regulatory authorities, are gaining traction among major banks and investors. MAS’s paper introduces the concept of Purpose Bound Money (PBM), which enables senders to define conditions like validity period and specific stores where the digital currency can be spent. The surveillance of money, as well as the control over how it’s spent could become a major oppression tool.

This initiative is a part of Project Orchid, a joint venture between MAS and several business entities. Project Orchid’s objective is to lay the groundwork for the use of digital currencies by developing essential platforms and infrastructure.

The paper elucidates the life cycle of PBM from its issuance to redemption and explains the protocol necessary for communication with supporting digital currencies. Notably, the PBM protocol is designed for versatility, allowing users to transfer digital assets and access digital money through a range of digital wallets, due to its compatibility with multiple ledger technologies and diverse forms of money.

JPMorgan, Amazon, and other contributors are currently initiating trials to test the PBM protocol for CBDCs, tokenized funds, and stablecoins.

As digital currencies forge a path into mainstream adoption, this collaborative endeavor positions Singapore at the forefront of innovation and regulation in the burgeoning digital currency domain.