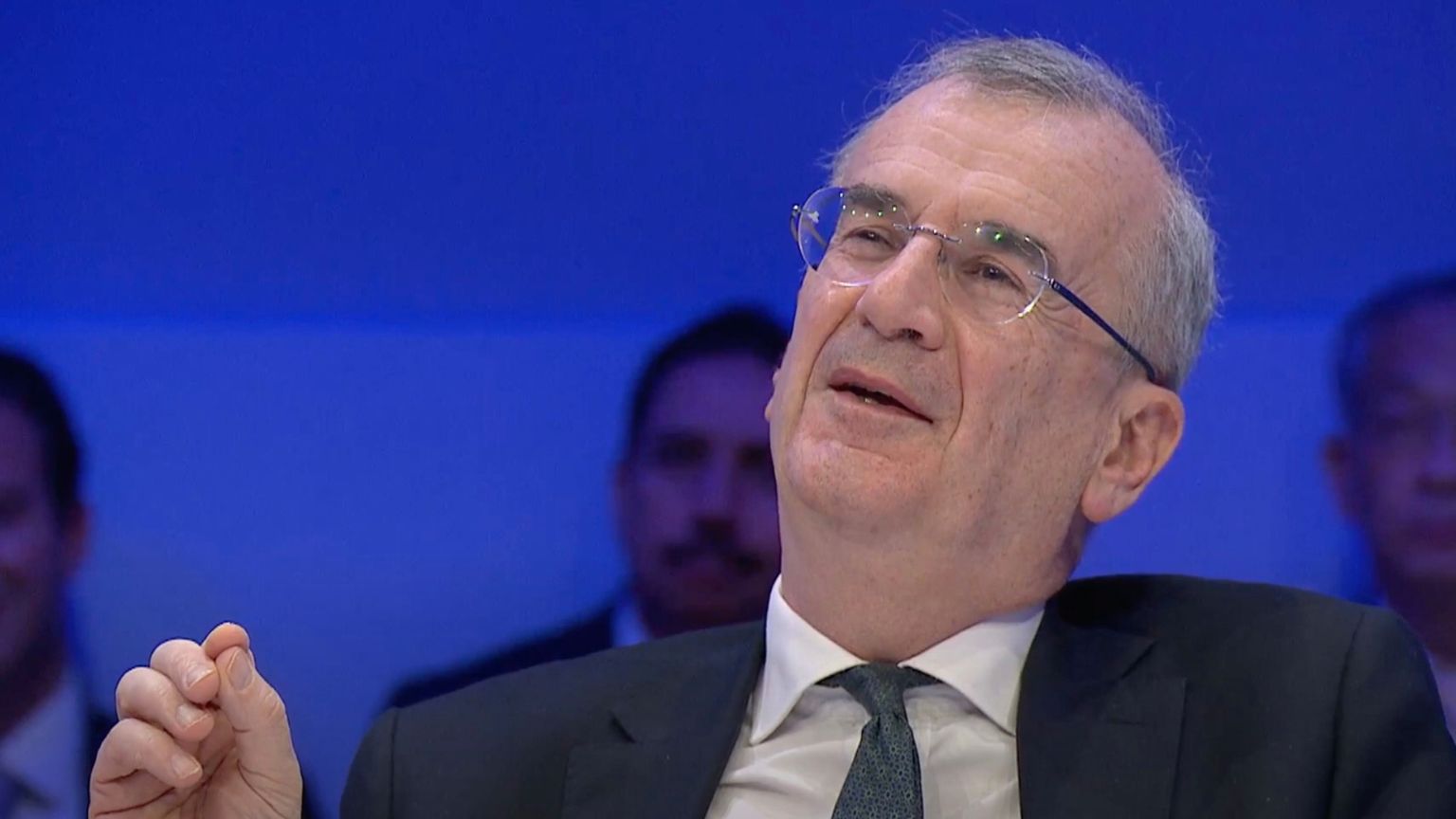

In a speech on the future of the European banking landscape, François Villeroy de Galhau, the Governor of the Banque de France, emphasized the inevitability of the digital euro. He was addressing commercial bankers at the Global Official Institutions Conference organized by BNP Paribas on June 22.

The Governor shifted his focus towards the concept of a central bank digital currency (CBDC) for the euro, CoinTelegraph reported.

He raised the question: “As everything is becoming digital, why should central bank money be the only thing to remain in paper?” Labeling the digital euro as “Cash+,” he asserted that this would essentially be akin to a digital banknote. While its usage would be optional, he argued for its significance in the growing digital economy, especially in e-commerce.

The Governor made it evident that the creation of a digital euro would be a collaborative venture between central and commercial banks. He emphasized their mutual interest in fostering tokenized finance and ensuring cross-border interoperability. He added that this alliance would bolster the European financial system against the invasion of non-European stablecoins.

He stated, “It’s very probably our duty to issue a CBDC, but it’s our will to issue it with you, commercial banks, and not against you.”

From a civil liberties perspective, the introduction of Central Bank Digital Currencies (CBDCs) raises several concerns. The most prominent among these is the potential erosion of financial privacy. Unlike physical cash transactions, which can be conducted anonymously, digital transactions leave a trail. This can empower governments and central banks with the ability to monitor, analyze, and even control the spending habits of individuals, potentially leading to unprecedented levels of financial surveillance.