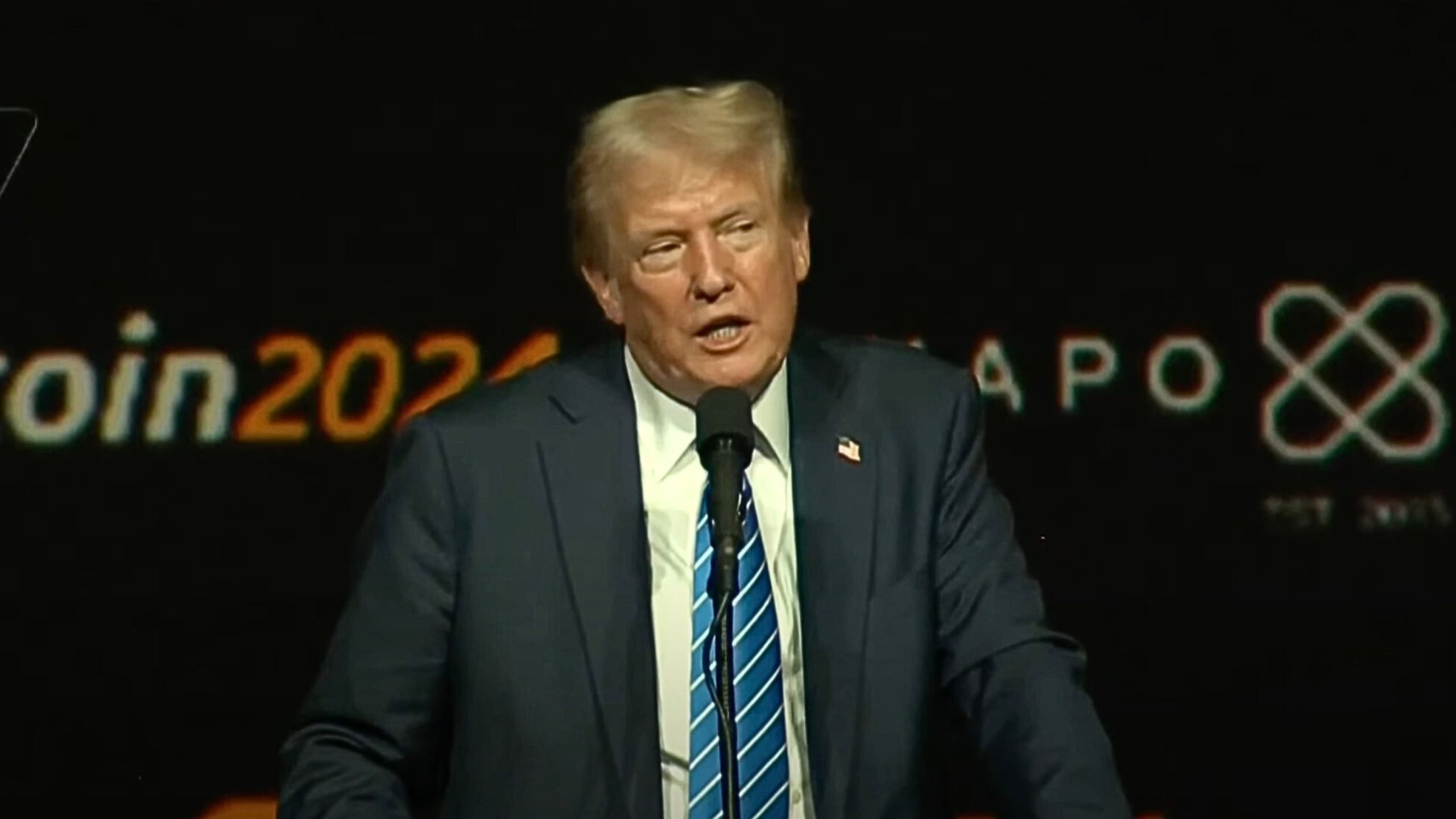

President Donald Trump has been quite vocal about central bank digital currencies (CBDCs) lately, and today was no exception. In his speech at the Bitcoin 2024 conference in Nashville, he made his stance crystal clear. He said, “There will never be a CBDC while I am president.”

This statement echoes his previous comments on the matter, where he has consistently expressed strong opposition to the idea of a CBDC. He believes that such a currency would give the government too much control over people’s money and could potentially lead to financial tyranny.

Related: CBDC Catastrophe: Tech Failures Expose a Fragile, Dystopian Future

Trump’s views on CBDCs seem to be part of a broader narrative that he’s building around protecting individual freedoms and liberties. It’s a message that resonates with many in the cryptocurrency community, who see digital currencies as a way to decentralize power and reduce government control.

Trump has previously called CBDCs a “dangerous threat to freedom.”

Trump’s firm stance underscores the escalating discussions surrounding CBDCs, a significant matter among global governmental bodies. To date, only a few countries have officially adopted such currencies. However, the digital currency landscape continues to evolve, with China advancing the implementation of its digital yuan, India progressing towards a digital rupee, and the European Central Bank initiating a preparatory phase for a potential digital euro.

CBDCs represent a significant evolution in the architecture of money. These digital forms of fiat currency, issued and regulated by a country’s central bank, promise enhanced efficiency in transactions and greater financial inclusion. However, they also pose potential risks to civil liberties that merit careful consideration. Here are some of the primary concerns:

1. Privacy

CBDCs could fundamentally alter the landscape of financial privacy. Traditional cash transactions allow for anonymity. With CBDCs, even small transactions might be traceable and recordable by the central bank. This could lead to a scenario where governments have access to detailed records of every individual’s financial life, raising significant privacy concerns unless robust safeguards are implemented.

2. Surveillance

The transition to a fully digital currency could potentially give governments unprecedented capabilities to monitor and surveil citizen behaviors. In regimes with weaker protections for civil liberties, this could be exploited to track political dissent or suppress opposition. The potential for surveillance not only impacts privacy but also freedom of expression and association.

3. Financial Censorship

With the centralization of currency issuance and transaction management, a CBDC could make it easier for governments to implement financial sanctions against individuals or groups without due process. Accounts could be frozen or transactions blocked more efficiently, which could be used as a tool for political repression or social control.

4. Exclusion

Despite the potential for greater financial inclusion, the reliance on digital infrastructure might marginalize those without access to technology or reliable internet, such as rural populations or the economically disadvantaged. This could exacerbate existing inequalities and restrict access to essential services for those on the fringes of the digital economy.

5. Cybersecurity Risks

The concentration of financial data in a central digital system increases the risk of systemic failures due to cyberattacks. A successful attack could compromise the integrity of a nation’s entire financial system. Moreover, the implications of such attacks extend beyond economic damage to potentially crippling impacts on individual financial security and privacy.

6. Centralization of Power

CBDCs concentrate monetary control significantly. This centralization of financial power could reduce the checks and balances provided by a more distributed banking system, increasing the potential for abuse by those in power, particularly in undemocratic regimes.

7. Legal and Ethical Implications

The implementation of CBDCs raises several legal and ethical questions, including the scope of government intervention in personal finances, the rights of individuals under a digital currency system, and the balance between national security and personal freedoms.