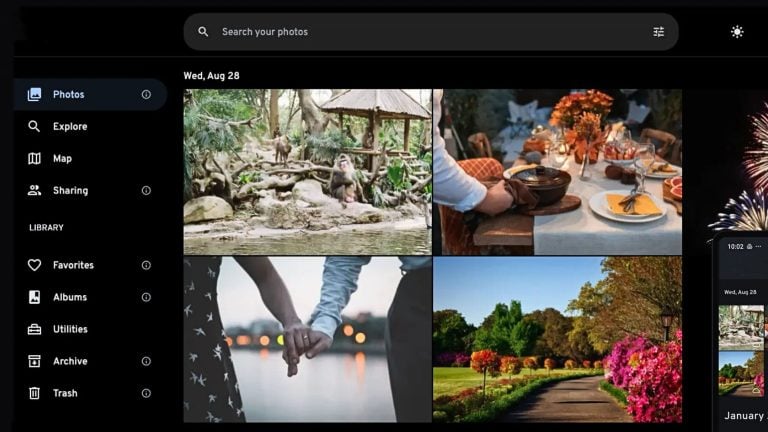

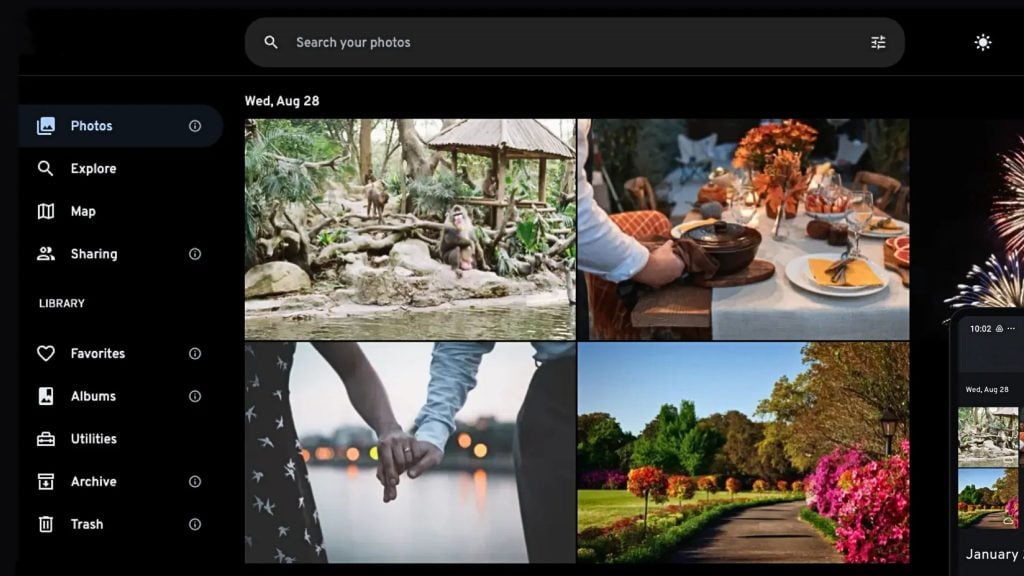

The Reserve Bank of India (RBI) said it will launch a phased pilot of its proposed central bank digital currency (CBDC) called the e-rupee.

In the “concept note” explaining the e-rupee, the RBI said it was trialing a digital currency to keep pace with other countries that have launched such programs, like China.

We obtained a copy of the note for you here.

“Currently, we are at the forefront of a watershed movement in the evolution of currency that will decisively change the very nature of money and its functions,” the paper states. “CBDCs are being seen as a promising invention and as the next step in the evolutionary progression of sovereign currency.”

Proponents of CBDCs claim they could make transactions faster and more secure. The e-rupee will be the alternative paper money and serve as an alternative to cryptocurrencies, according to the RBI, which views cryptocurrencies as a risk to the financial stability of India.

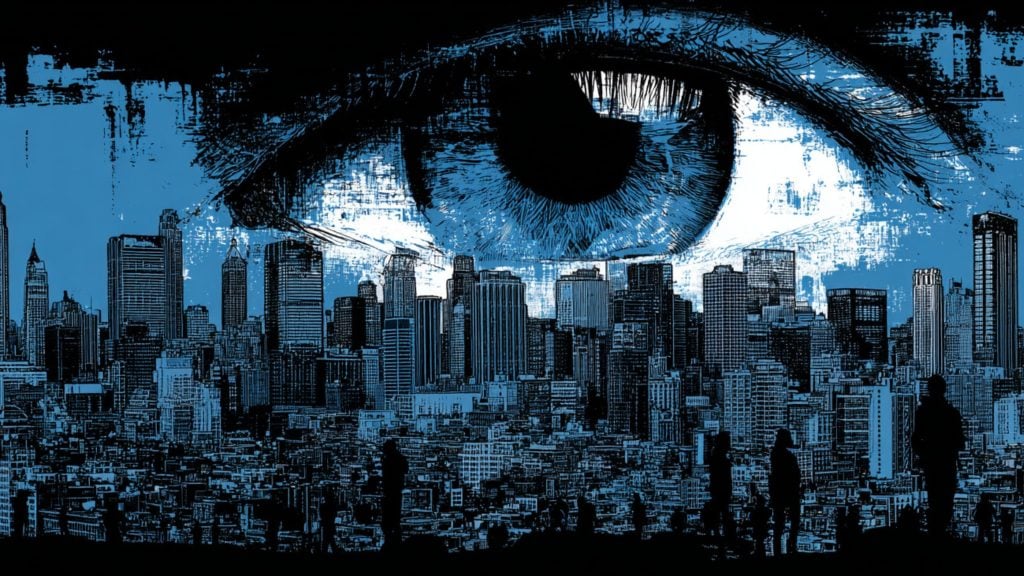

Related: ? Central Bank Digital Currencies make authoritarianism, censorship, and surveillance easy

“CBDCs will provide the public with [the] benefits of virtual currencies while ensuring consumer protection by avoiding the damaging social and economic consequences of private virtual currencies,” the RBI said.

The RBI acknowledges that CBDCs would not provide the same level of anonymity as paper money.

“The potential for [an] anonymous digital currency to facilitate [a] shadow-economy and illegal transactions makes it highly unlikely that any CBDC would be designed to fully match the levels of anonymity and privacy currently available with physical cash,” the RBI wrote.