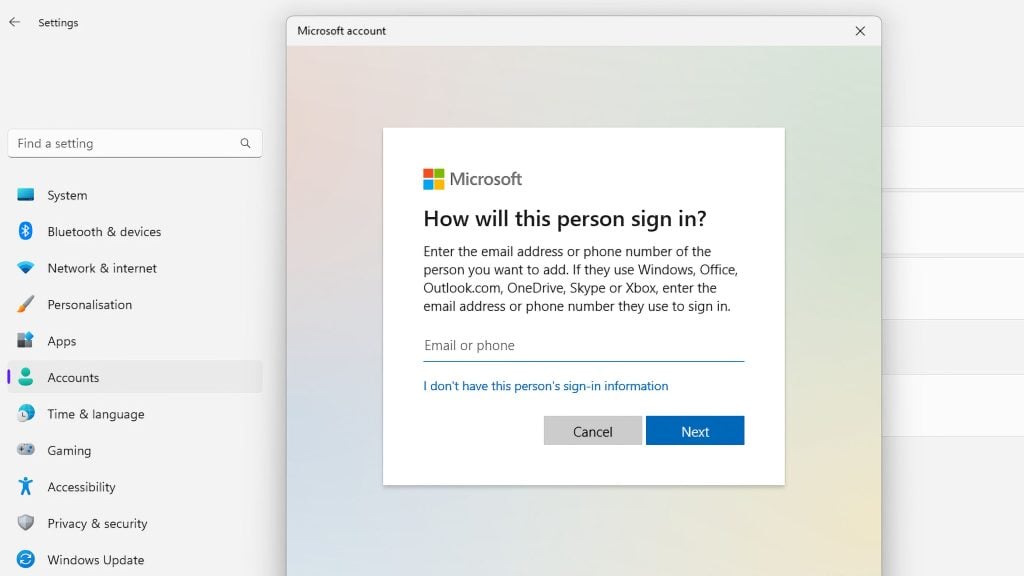

Greece’s new government will next year begin forcing citizens to spend at least 30 percent of their income electronically, or face penalties.

The Sydney Morning Herald calls these “hefty fines”: 22 percent on whatever the difference is between the target 30 percent, and the percentage of their income that citizens had actually spent electronically.

As the website calculated, workers who earn 1,000 euros a month but spend only half the goal – 15 percent – electronically will have to pay a fine of 400 euros a year.

The drastic step is explained as the need to fix the county’s shadow economy – i.e., the portion that is not monitored by the government and is untaxed – in order to bring more revenues to the state coffers.

The Greek government expects to win either way: by collecting more taxes as spending is channeled to where the government can see it and impose VAT, or by collecting fines from those who fail to meet the goal. The government hopes to rake in 500 million euros every year in this way, out of the estimated 16 billion it loses through tax evasion.

This is a new and radical take on the “war on cash” – a policy promoted by many countries around the world, seeking to suppress the use of cash in order to allow tax administrations to track citizens. The loss of financial privacy and high potential for abuse in terms of surveillance and civil liberties violations is often cited by those opposed to the trend.

And now the Greek government is bringing to the table an the element of enforcement and significant monetary fines for those resistant to switching to electronic transactions.

The article suggests some citizens who are now a part of the shadow economy will find it objectively difficult to spend 30 percent of their income electronically in a country that has the lowest internet usage rate in the EU – only 72 percent of the population.

Banks have been enlisted to report to the authorities on the citizens’ spending compliance. None of this, of course, will apply to those Greek workers who still receive their wages in cash – and according to the article, these are “many.”