Banking industry officials and other financial services firms are bracing for a long fight over a bill that will require banks to share consumer account information with the Internal Revenue Service to boost federal tax revenue.

This notion originally gained traction this spring within the American Families Plan by the Biden administration. But bankers and even some consumer groups have slammed it as a compliance concern and a privacy issue. Financial institutions already provide the IRS with large quantities of data.

As part of the 3.5 trillion dollar budget reconciliation package proposed by the Biden administration, legislators are considering this invasive proposal as an income source to fund the massive budget.

The Biden administration argued that bank surveillance would prevent tax evasion, but many are obviously concerned that it’s a breach of the Fourth Amendment (which protects people from unreasonable searches and seizures by the government) and would also favor those who are embracing the move towards decentralized finance and cryptocurrencies, as well as those that use off-shore accounts.

The proposals would force banks to report every deposit and withdrawal related to a bank account and would also include centralized companies such as PayPal, Venmo, (owned by PayPal), CashApp, and cryptocurrency exchanges.

This would take place on bank accounts that have an incoming or outgoing amount of $600 within a year, meaning that most Americans would be the target of the surveillance.

The proposals would mean the IRS would have up-to-date information about how much cash is in a citizens’ bank account.

“For non compliant taxpayers, this regime would encourage voluntary compliance as evaders realize that the risk of evasion being detected has risen noticeably,” the Treasury Department said when asked for comment.

The American Bankers Association, the Consumer Bankers Association, and the Bank Policy Institute wrote a letter to the Senate Subcommittee on Finance earlier in the year, arguing against the extreme surveillance measures.

In the letter, (we obtained a copy for you here) the groups argue that the “new reporting requirements for financial institutions would impose cost and complexity that are not justified by the potential, and highly uncertain, benefits.”

In an age where decentralized finance looms on the horizon, the proposals targeting the traditional banking sector would be a major increase in surveillance over the bank accounts of everyday Americans.

The Electronic Transactions Association’s senior vice president of government affairs, Scott Talbott said: “From a bank perspective, the administrative challenges and complexities of having a $600 annual threshold may not achieve the policy goals of reducing tax avoidance. At $600, the squeeze may not be worth the juice.”

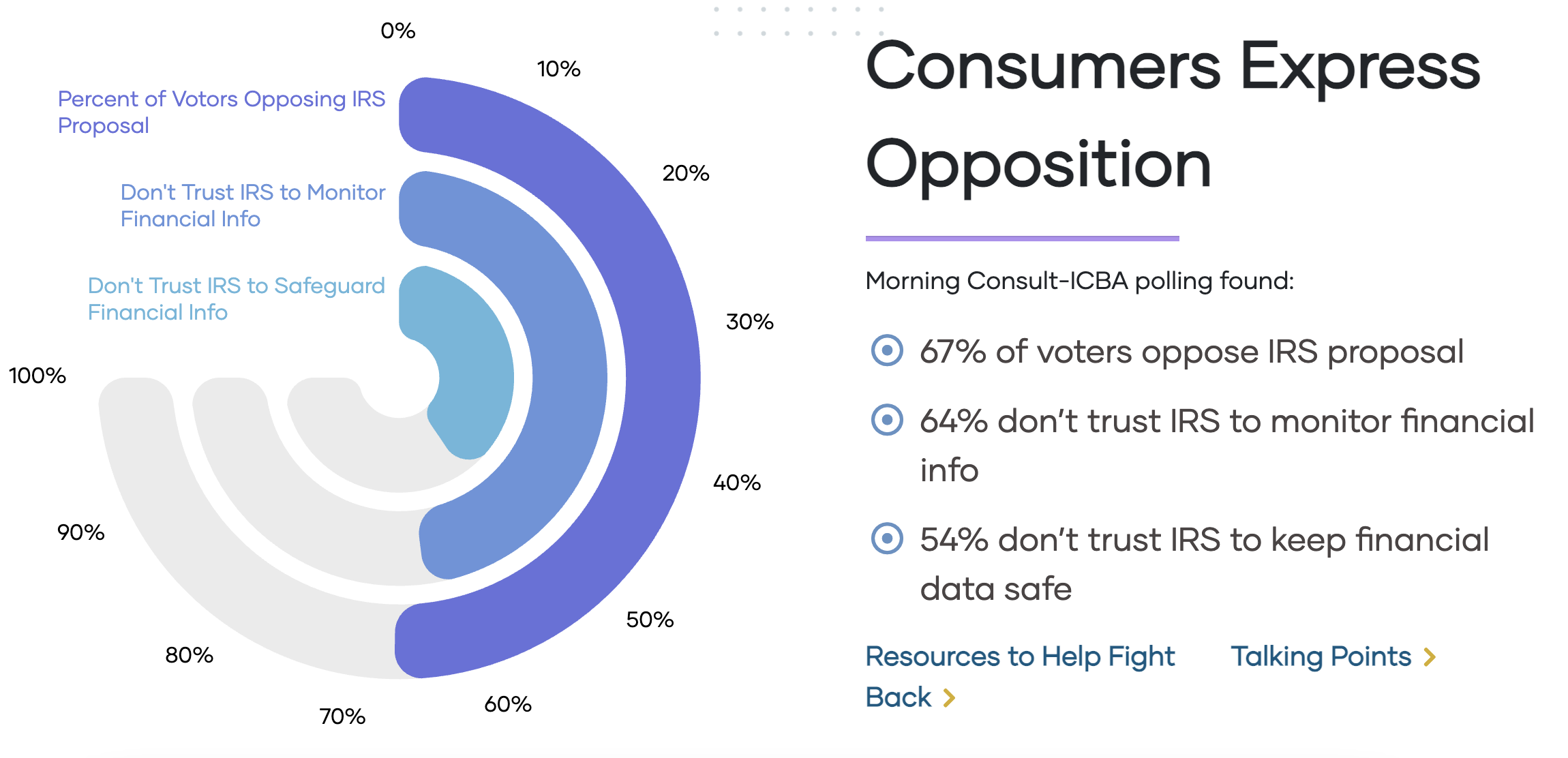

This week, the results of a survey conducted by the ICBA found that 67% of those asked were against Biden’s proposal.

In the event that Biden’s proposed reporting measure makes it to the final phase of discussion, the sector is expected to lobby Congress to at least raise the reporting level well above $600.