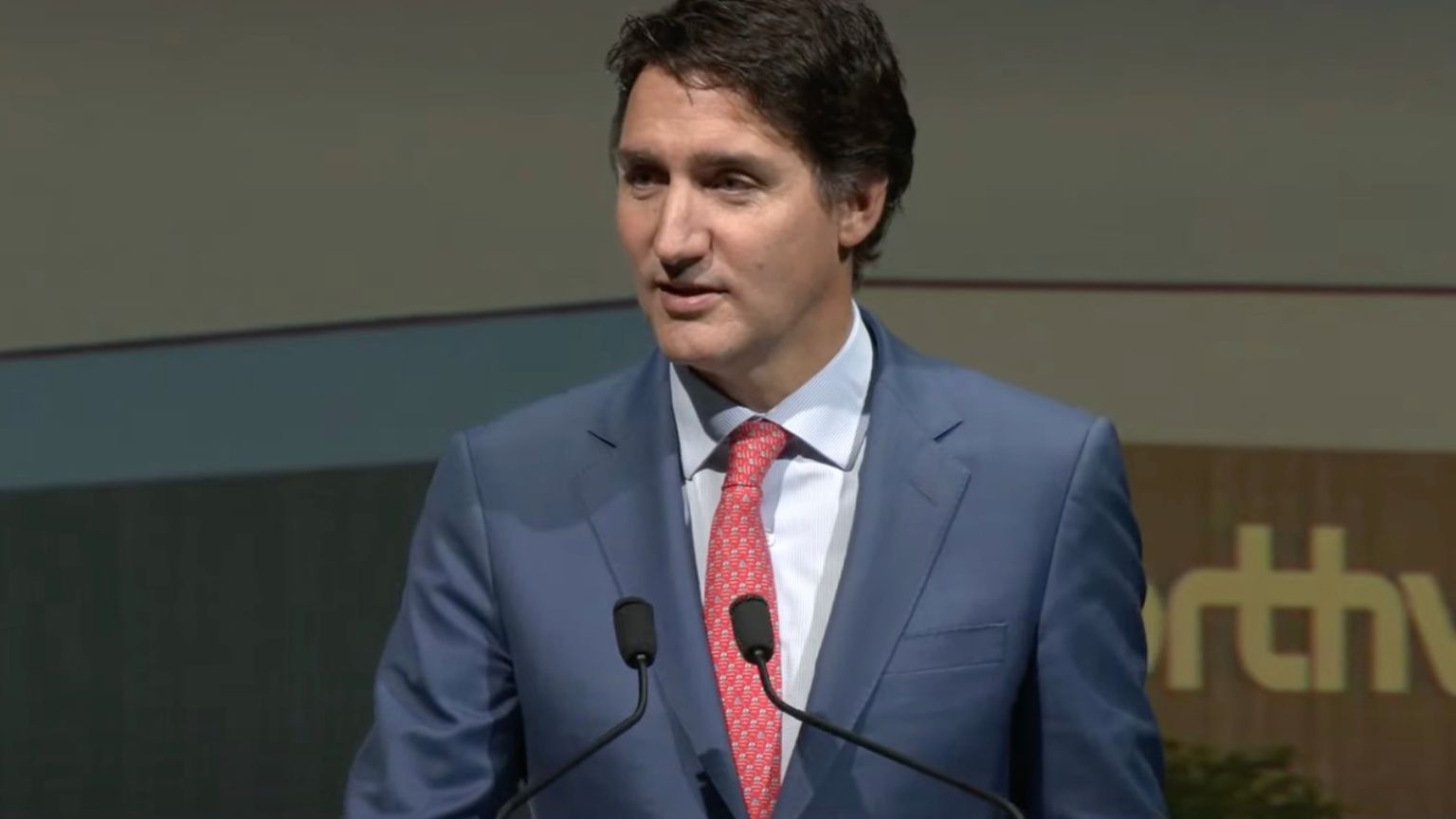

A sweeping de-banking wave has swept across Canada, affecting over 800 citizens in its tide since 2018, a number which includes hundreds who rallied behind the banner of the Freedom Convoy. Data unearthed through an access-to-information request by Blacklock’s Reporter unveiled a disturbing pattern where 837 individuals found the doors of their banks slammed shut on them over a span of five years.

The Financial Consumer Agency of Canada was brought into the loop through grievances lodged with regulatory bodies, shedding light on financial strangulation that bypassed cases of validated terrorism and money laundering.

In a deeper dive into the numbers, it’s revealed that the financial shackles tightened around 267 bank accounts and 170 Bitcoin wallets belonging to Freedom Convoy supporters, ensnaring an estimated $7.8 million. This exercise in financial censorship spun a web of scrutiny during a hearing on March 7, 2022, where Angelina Mason, representing the Bankers Association, testified. Mason outlined that while the Royal Canadian Mounted Police (RCMP) supplied a list of names, banks were also mandated by separate orders to exercise their judgment in identifying account holders for de-banking.

The narrative grew murkier when New Democrat MP Daniel Blaikie queried about the fate of individuals who were debunked but never featured on the list provided to the RCMP, to which Mason’s one-word response was a stark “Yes.”