During a US Senate Banking, Housing, and Urban Affairs Committee hearing titled “Investigating the Real Impacts of Debanking in America,” senators and witnesses laid out how Joe Biden’s administration, regulators, overbearing rules, big banks, and more had resulted in millions of Americans being blacklisted from the banking industry.

The Biden Administration’s Role in Debanking

Throughout the hearing, witnesses and senators noted that Biden regime pressure was a major contributor to this debanking wave, particularly through Operation Choke Point 2.0, a Biden-era push that primarily focused on pressuring banks to refuse to service cryptocurrency companies.

These claims were bolstered by the Federal Deposit Insurance Corporation’s (FDIC’s) release of 175 pages of documents before the hearing, which, according to FDIC Acting Chairman Travis Hill, show that banks that sought to offer crypto-related products or services were “almost universally met with resistance” from the FDIC, with some of this resistance coming in the form of “directives from supervisors to pause, suspend, or refrain from expanding all crypto- or blockchain-related activity.”

“Under the Biden administration, we’ve seen the rise of what many are calling Operation Choke Point 2.0, where federal regulators exploited their power, pressuring banks to cut off services to individuals and businesses with conservative dispositions, or folks aligned with industries they just didn’t like, like the color of one’s skin in my family’s history,” Senate Banking Committee Chairman Tim Scott (R-SC) said. “I wholeheartedly believe that debanking someone over their political ideology is un-American and goes against the core values that our nation was founded upon.”

Scott added that the newly released FDIC documents “further proved that Choke Point 2.0 was real” and “paint a disgusting and disheartening picture of abuse.”

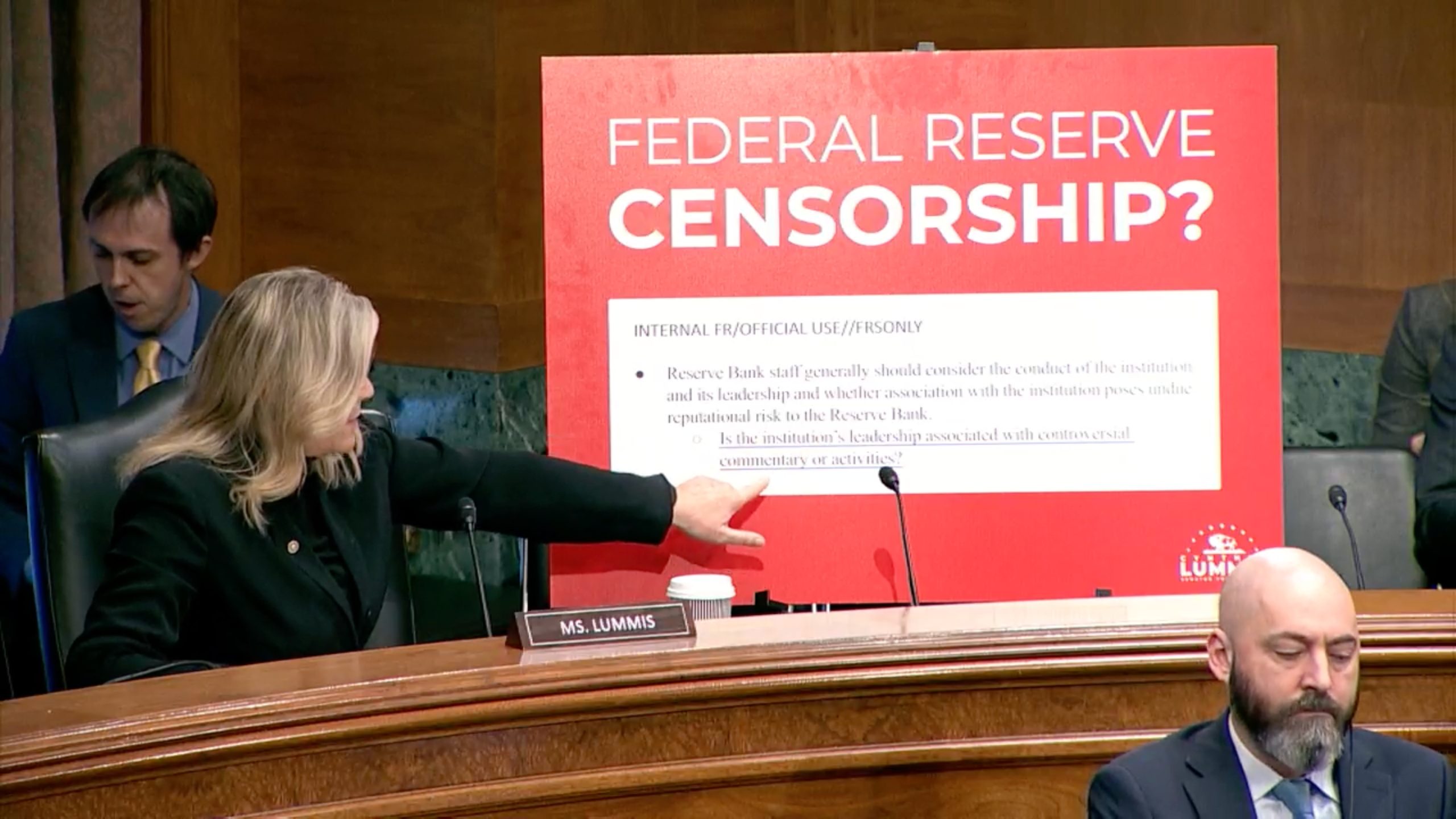

Senator Cynthia Lummis (R-WY) also showcased a quote from a confidential Federal Reserve implementation handbook on account actions that she described as “hard proof of Operation Choke Point.” The quote in question requires Federal Reserve staff to “consider the conduct of the institution and its leadership and whether association with the institution poses reputational risk to the Reserve Bank.”

One of the witnesses, Davis Wright Tremaine LLP Partner Stephen Gannon, was shocked by the quote, saying he’d “never seen anything like that before” and that “it’s really quite unusual.”

“Who’s to say what is controversial and what is not controversial?” Gannon added. “It’s chilling to me that it’s possible that access to the Federal Reserve payment system might be dependent on whether the applicant was engaged in some sort of controversial commentary…or activities…We don’t want to be in a place where free speech is chilled because there’s a concern that I might not get access to banking services.”

Related: Guilty Until Proven Innocent: How Financial Institutions Quietly Put You Under the Microscope

Senator Pete Ricketts (R-NE) also slammed the Biden administration for the way it “weaponized government at all different levels” and targeted the crypto industry.

And when Ricketts questioned Gannon on Operation Choke Point 1.0 (a 2013 Obama-era debanking effort that targeted gun dealers, payday lenders, and other companies considered to be “high risk”) and Operation Choke Point 2.0, Gannon said these efforts had resulted in “many small, perfectly legal businesses” ceasing operations.

Other Debanking Pressure Valves

While the Biden administration and its actions during Operation Choke Point 2.0 were identified as major contributors to debanking, participants also shone a light on the confluence of other factors that led to businesses and people losing access to financial services.

Big banks denying access to customers was one such factor. Senator John Kennedy (R-LA) asked Mike Ring, the President, CEO, and Co-Founder of the freedom-focused bank, Old Glory Bank, to name the American banks that “have been discriminating, debanking customers because of their religious beliefs, because they support the Second Amendment, or because they hate fossil fuels.” Ring responded by saying Bank of America has “certainly picked and choose [sic] winners” and also named Chase Bank, Citibank, and KeyBank.

Overburdensome regulations that lack transparency were also pointed to as a reason customers are excluded from the financial system.

During an exchange with Senator Jack Reed (D-RI), Ring slammed the Bank Secrecy Act (BSA), an anti-money laundering (AML) law that requires banks to file Currency Transaction Reports (CTRs) for transactions involving more than $10,000 in cash and Suspicious Activity Reports (SARs) for transactions they deem suspicious, describing it as “the Trojan horse for banks to do whatever they want.”

Aaron Klein, a Senior Fellow in Economic Studies at the Brookings Institution, said that the AML rules have created an exclusionary system that results in banks excluding low profit customers:

“I think one of the problems that we have in our anti-money laundering system is we’ve created an economic structure where the costs are very high. And the banks respond by saying, ‘If you’re a low-profit customer, we don’t want you because of the AML cost, but if you’re a high-profit customer, we’ll just pay the AML fine.'”

And Senator Andy Kim (D-NJ) shone a light on the “excessive amount of reporting” banks have to file and the lack of transparency around SARs, which are usually filed without customers having any awareness of them or having the ability to appeal.

Senator Bill Hagerty (R-TN) summed up the overall sentiment and explained how a “constellation of problems exists at multiple levels” and that these problems are created by “partisan ideologues that actually operate within banks, public affairs divisions, or their so-called reputational risk committees that are exerting their influence to choke off disfavored industries,” external pressure from political activist groups, proxy advisory firms, and “activist regulators that have abused their supervisory authority.”

Hagerty added that this has ultimately created a “de facto debanking” system where “unelected individuals that are dictating what kind of companies can exist and thrive in our nation, and with no directive at all from the American people or from their elected representatives.”

The Devastating Impact of Debanking

Several witnesses and senators shared personal horror stories and shocking statistics that highlighted just how destructive this scourge of debanking has been.

Nathan McCauley, the CEO and co-founder of Anchorage Digital, a crypto bank for institutions, detailed how his bank was “virtually shut out of the federal banking system, despite being a federal bank ourselves.” His debanking nightmare began in June 2023 when a partner bank told him they were closing Anchorage Digital’s corporate bank account in 30 days because “they were not comfortable with our crypto clients and their transactions” and refused to provide any further explanation. McCauley added that the partner bank had never previously raised any issues with the account during Anchor Digital’s years-long relationship with them and that Anchorage Digital was even having active talks with them to expand into new partnerships.

While Anchorage Digital was ultimately able to find other banks to partner with, McCauley said “the impact of nearly being shut out of the banking system was devastating,” caused extreme disruption to his business, and contributed to his bank laying off 70 US-based employees.

Gannon provided an example of the debanking pressure small businesses face when they attempt to push back against regulators. He described how the Federal Deposit Insurance Corporation (FDIC), a banking regulator that provides deposit insurance to depositors in American commercial banks and savings banks, had demanded that a small bank stop making legal tax refund application loans. When the bank refused, it found itself subjected to a review staffed by 400 FDIC examiners.

Senator Elizabeth Warren (D-MA) said her staff had identified 11,955 complaints to the Consumer Financial Protection Bureau (CFPB), the US government consumer protection agency in the financial sector, about debanking over the last three years. Warren also claimed that consumer complaint hotline data has shown “tens of millions of customers have been blacklisted by the banking industry because they overdrafted their account a few times.” Warren even agreed with President Donald Trump’s stance on debanking, saying, “Donald Trump was on to a real problem when he criticized Bank of America for its debanking practices.”

Calls for Banking Reform

Although much of the hearing focused on the extensive list of problems that are plaguing the banking system, Klein proposed five solutions to reduce instances of unjust banking going forward were proposed.

Klein suggested five solutions during his opening statement:

- A requirement for all banks to offer bank-on-style accounts, which he described as “affordable, low-fee, non-overdraft accounts.”

- Reducing penalties and surprise fees that debank the financially vulnerable.

- Improving the design of the financial system to better serve working people by introducing solutions like real-time payments.

- Reforming AML by increasing the $10,000 CTR limit and reforming SARs.

- Reforming the do not bank list systems “where you get kicked out for being just poor, not for fraud.”

Scott also closed the hearing with a vow that the public would hear more from lawmakers on this subject.

“This will not be the last time we have an opportunity to talk about debanking in this nation,” Scott said.

You can watch the full hearing here.