Russia’s monetary future has become a hotbed for debate as the country’s parliament accelerates the adoption of the digital ruble, its central bank digital currency (CBDC) project.

The bill, which has now passed through the State Duma, the lower chamber of the Federal Assembly, will raise eyebrows among privacy advocates. While the legislation is set to move to the Federation Council, the assembly’s upper chamber, and potentially on to the president’s desk for final approval, the implications for individual privacy in this digital landscape remain troubling.

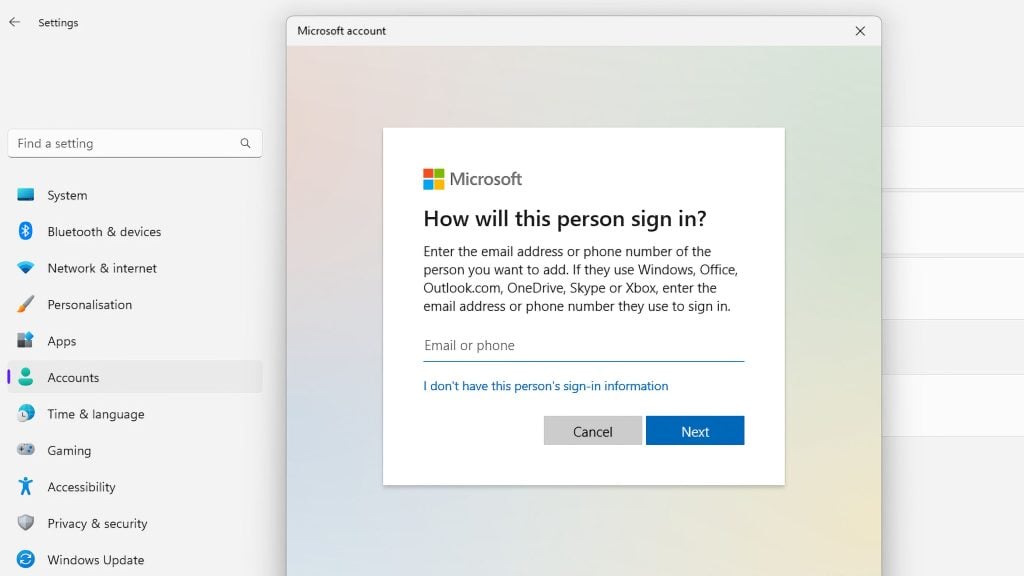

Amendments to the legislation were made at the end of June, including defining the terms “platform,” “participants,” and “users.” These definitions create the framework of the CBDC ecosystem, but they also cast a spotlight on the potential privacy intrusions embedded in the digitization of financial transactions.

The Bank of Russia (BoR), under the proposed legislation, is slated to manage the digital ruble infrastructure and maintain responsibility for all stored assets. However, the centralized nature of this structure, with the BoR at the helm, potentially exposes users to unprecedented levels of financial scrutiny, as every transaction could be tracked and monitored.

According to the BoR, the primary purpose of the digital ruble is to act as a medium for payments and transfers. The proposed rules prohibit individuals from opening savings accounts, making the digital currency primarily transactional.

While individual transactions would be free and corporate ones would be charged a nominal 0.3%, the real cost may be the potential compromise of personal privacy, as all transactions could be traced.

The digital ruble was first proposed in the State Duma in December 2022, and since then it has raised significant concerns over the impact on traditional banking systems. Gazprombank, a subsidiary of a leading Russian government-owned gas company, echoed these concerns in February, highlighting the potential risks of an abrupt transition to digital currencies. Moreover, according to an analysis by McKinsey’s Russian branch, the digital shift could result in losses to traditional banks of approximately 250 billion rubles ($3.5 billion) over five years. Simultaneously, it predicts an annual profit of $1.1 billion for retailers.

Despite these concerns, the digital ruble is slated for a pilot test between 2023 and 2024 and full implementation by 2027, according to the central bank’s deputy chairman, Olga Skorobogatova. As the nation edges closer to this digital future, the balancing act between financial innovation and privacy protection is set to be a continuing debate.