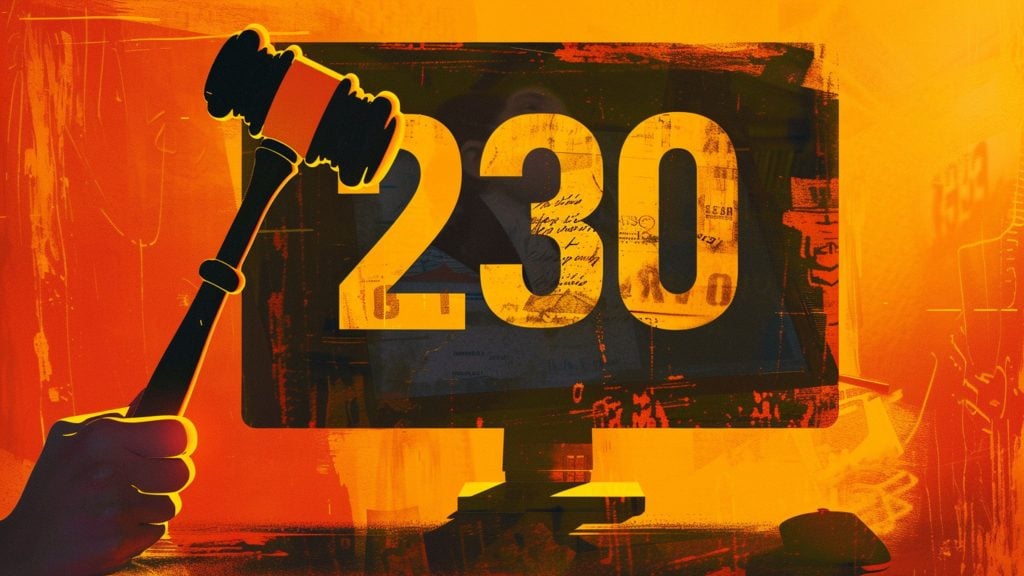

Opposing the prevailing winds of centralized digital currencies, GOP lawmakers are launching legislation aimed at inhibiting the federal government from implementing a Central Bank Digital Currency (CBDC).

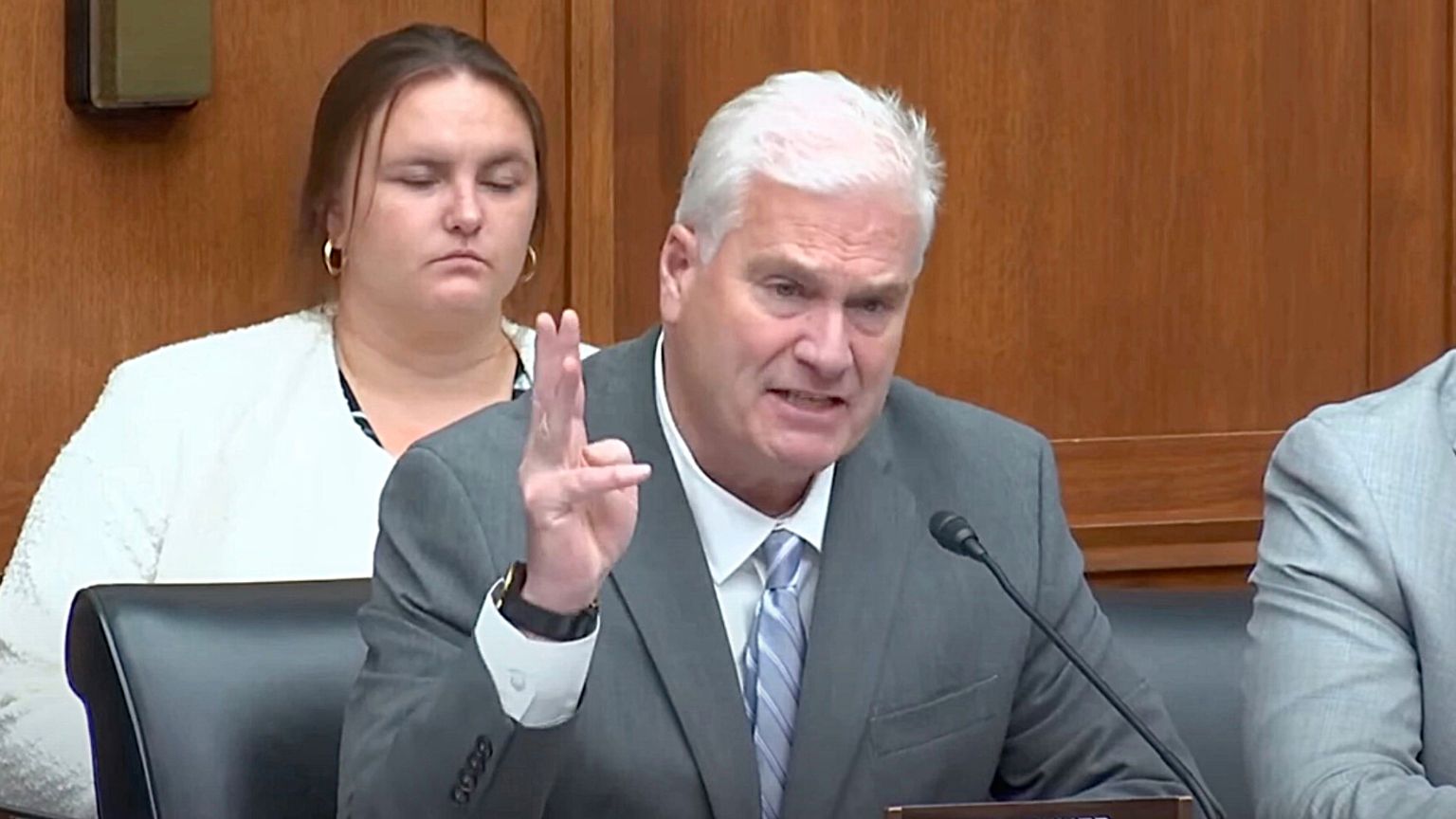

Led by House Majority Whip Tom Emmer, the Central Bank Digital Currency Anti-Surveillance State Act resurfaces on the House floor, seeking to put the brakes on the Federal Reserve’s exploration of a digital version of the dollar – a move that could significantly influence monetary policies.

The increasing popularity of CBDCs worldwide can not be ignored, as 130 countries, making up 98% of the global economy, conduct explorations of their own – 11 of which, including China, have fully transitioned into CBDC use as per findings from Atlantic Council’s GeoEconomics Center.

Despite the grouping of cryptocurrencies and CBDCs under the category of digital assets, they produce a strong sense of discord among crypto enthusiasts and privacy activists.

Republicans like Emmer put forth the argument that CBDCs would only serve to intensify surveillance activities by the state – a reason why China is leading the parade of countries implementing CBDCs.

Emmer’s updated bill primarily seeks to prohibit “intermediated CBDCs” – CBDCs issued by the Fed but managed by financial intermediaries such as retail banks, a strategy that China employs for its digital yuan.

“The administration has made it clear: President Biden is willing to compromise the American people’s right to financial privacy for a surveillance-style CBDC. That’s why I’m reintroducing my landmark legislation to put a check on unelected bureaucrats and ensure the United States’ digital currency policy upholds our values of privacy, individual sovereignty, and free-market competitiveness,” Emmer said. “If not designed to be open, permissionless, and private – emulating cash – a government-issued CBDC is nothing more than a CCP-style surveillance tool that would be used to undermine the American way of life.”