The Fed (US Federal Reserve, the central bank) does not appear to be one of those institutions whose word you could, so to speak – take to the bank.

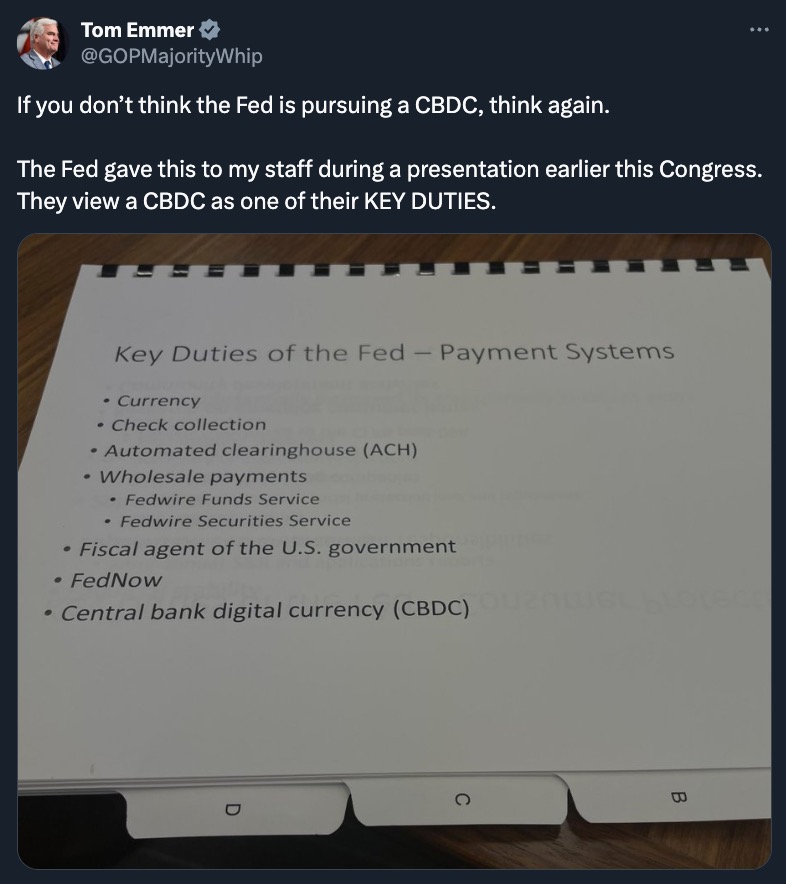

Just as it is reassuring the public that it is not focusing on introducing a central bank digital currency (CBDC) in the country, the Fed has only recently been telling Congress that steps leading to a digital dollar are among its “7 key duties.”

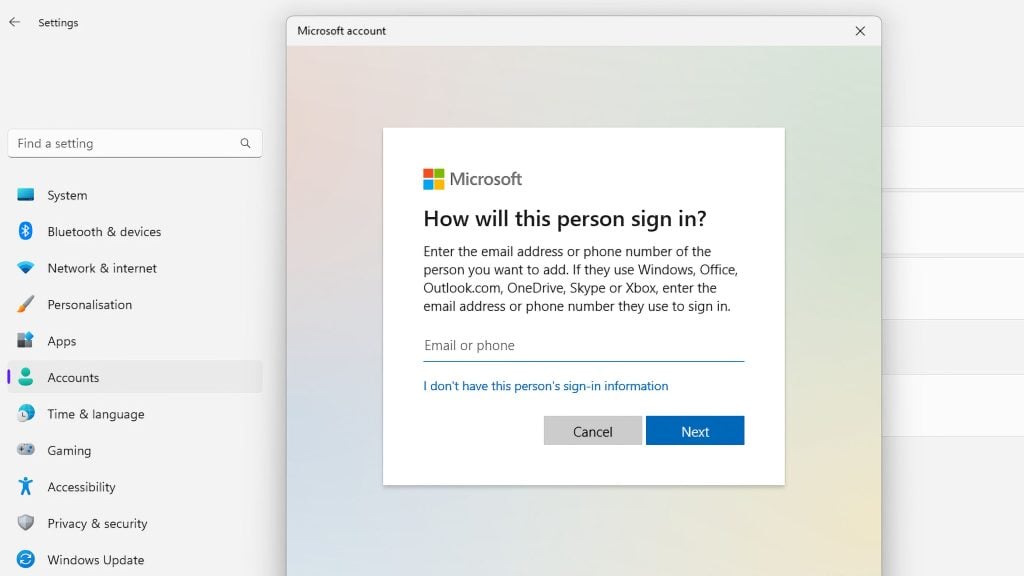

This is according to Congressman Tom Emmer, who posted a document on X on March 14, explaining that his office received it as the Fed representatives were in Congress for a presentation.

What caused the alarm is the mention of Automated Clearinghouse and FedNow among the “key duties,” as these payment systems are seen as a way to move towards a CBDC.

It’s been two years since the US Central Bank first came out with a paper looking into this possibility, and is also linked with the Digital Dollar Project, so this should not be seen as controversial per se.

However, just one week before the presentation document Congressman Emmer was referring to when he posted, “If you don’t think the Fed is pursuing a CBDC, think again” – the Fed was in the Senate, where Chairman Jerome Powell told the Banking, Housing and Urban Affairs Committee that adopting or even recommending a US CBDC was a something that was “nowhere near (…) in any form.”

“People don’t need to worry about it,” Powell also said.

But people do, and that was true even before this latest development commented on by Emmer. The ability of the state to impose financial surveillance over the population – in the vein of what is already happening in China in earnest – is the main reason for this.

The most vocal opponents in Congress are Republicans, while former President Donald Trump, who is likely to run for office again later this year, has vowed to stop a US CBDC, describing it as “a dangerous threat to freedom.”

However, the Fed – despite its chair appearing to be convincing America that this “danger” is in no way imminent, has had highly positioned officials like Vice Chairman Lael Brainard push for it.

Putting aside the implications on the financial freedom of Americans, Brainard is reported as saying a CBDC would “reinforce global dollar dominance” and be “a safe central bank liability in the digital financial ecosystem.”