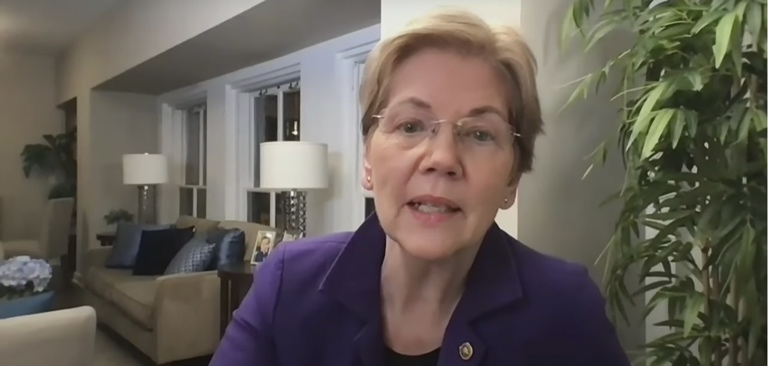

Senator Elizabeth Warren is demanding that the Securities and Exchange Commission (SEC) investigate whether the impact Reddit, online message boards, and "broader social media amplification" had on the price of GameStop stock is in violation of existing securities laws.

The price of several stocks, including GameStop, were driven to new highs this week after being boosted by conversations in online communities such as WallStreetBets. Many of the retail traders who bought these stocks were big winners but hedge funds that had shorted these stocks and attempted to profit from the stock price going lower took huge losses.

While some mainstream media outlets have attempted to frame these posts about stocks in Reddit communities as "market manipulation," experts have argued that this is not the case.

Former federal prosecutor Renato Mariotti, who has previously worked in the Securities & Commodities Fraud Section of the US Attorney's Office, said "it doesn't look like the Redditors who bought GameStop have to worry about any liability for manipulation."

…

Become a Member and Keep Reading…

Reclaim your digital freedom. Get the latest on censorship, cancel culture, and surveillance, and learn how to fight back.

Already a supporter? Sign In.