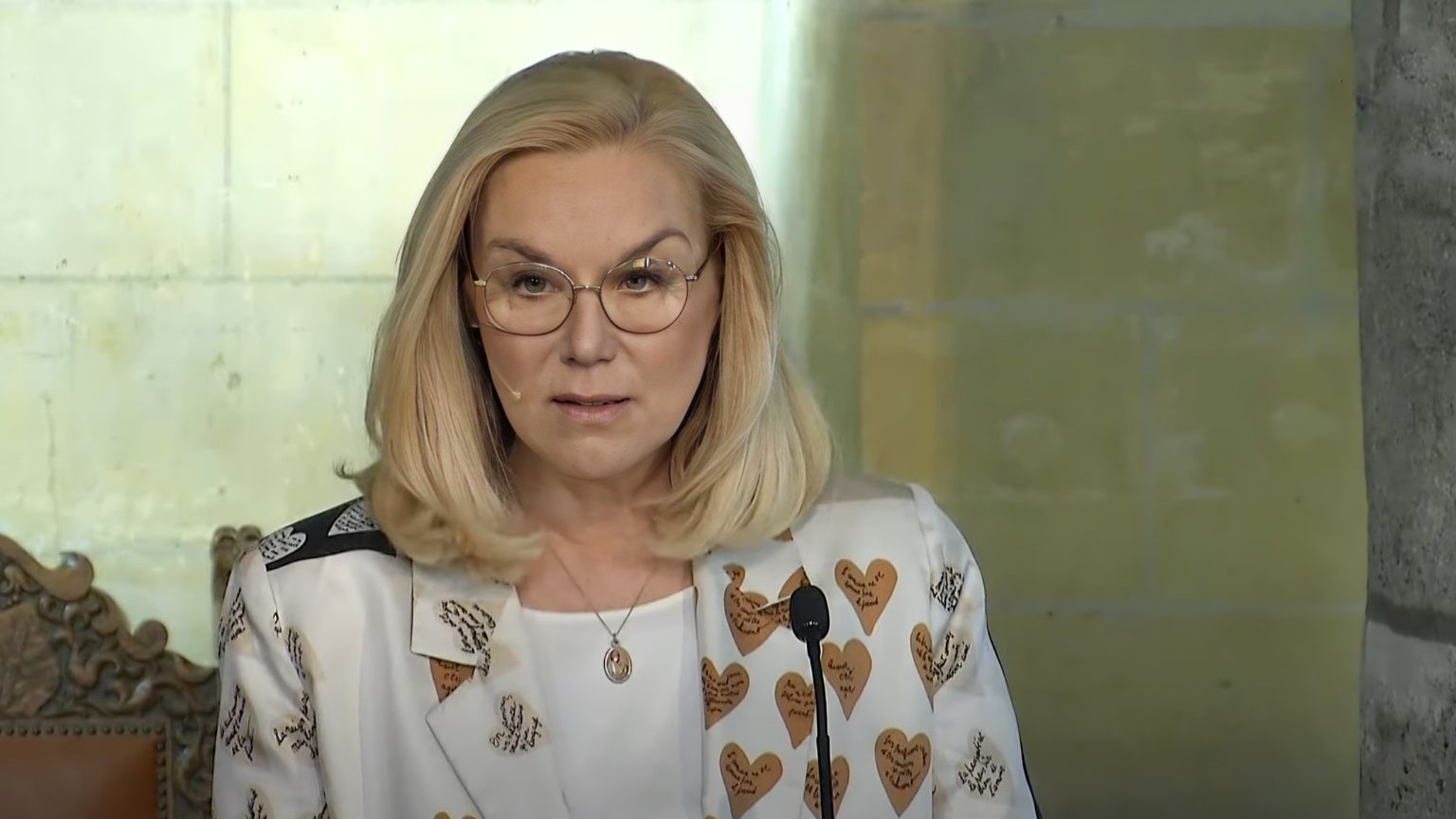

Dutch minister of finance Sigrid Kaag is pushing for the introduction of a central bank digital currency (CBDC) in the Netherlands and the passing of a law requiring banks to monitor all transactions above 100 euro, GB News reported.

The European Central Bank is also pushing for a digital euro. But critics warn that CBDCs can be used to track and monitor citizens, potentially violating some civil liberties.

Related: Central Bank Digital Currencies make authoritarianism, censorship, and surveillance easy

In July, Kaag wrote a letter to the House of Representatives about the digital euro, saying,“The introduction of the digital euro is becoming increasingly real. I think it is important that we in the Netherlands, with our innovative and open economy, actively participate in this thinking.”

…

Become a Member and Keep Reading…

Reclaim your digital freedom. Get the latest on censorship, cancel culture, and surveillance, and learn how to fight back.

Already a supporter? Sign In.