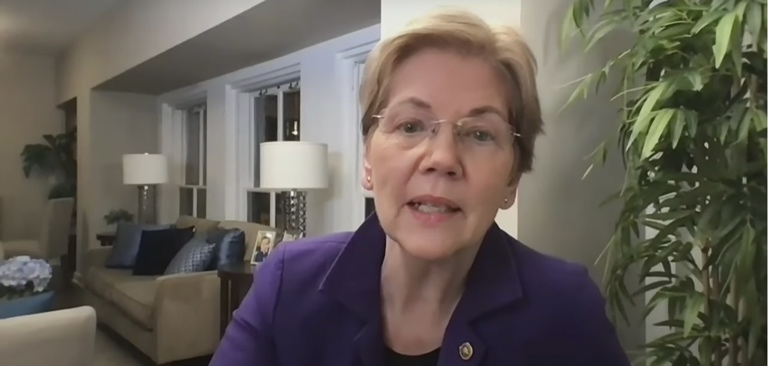

Senator Elizabeth Warren is demanding that the Securities and Exchange Commission (SEC) investigate whether the impact Reddit, online message boards, and “broader social media amplification” had on the price of GameStop stock is in violation of existing securities laws.

The price of several stocks, including GameStop, were driven to new highs this week after being boosted by conversations in online communities such as WallStreetBets. Many of the retail traders who bought these stocks were big winners but hedge funds that had shorted these stocks and attempted to profit from the stock price going lower took huge losses.

While some mainstream media outlets have attempted to frame these posts about stocks in Reddit communities as “market manipulation,” experts have argued that this is not the case.

Former federal prosecutor Renato Mariotti, who has previously worked in the Securities & Commodities Fraud Section of the US Attorney’s Office, said “it doesn’t look like the Redditors who bought GameStop have to worry about any liability for manipulation.”

Yet Warren is calling for the SEC to review the situation, provide new rules that define “market manipulation,” and even questioning the legality of “social media amplification” in relation to GameStop’s stock price.

In her letter to the SEC, Warren describes how the hedge fund Melvin Capital Management was set to reap “substantial profits” from the price of GameStop stock going down and expresses concern over online communities driving the increase in GameStop’s stock price.

“Hedge funds, such as Melvin Capital Management, have bet that GameStop’s shares would fall in the hopes of reaping substantial profits,” Warren writes in the letter. “In recent weeks, however, share prices for GameStop began to rise, with a dramatic surge in recent days fueled not by any changes in the company’s economic fundamentals but by anonymous traders on the Reddit forum r/WallStreetBets.”

Warren then invokes federal securities law and takes aim at online anonymity:

“Although ‘federal securities law prohibits market participants from misrepresenting a company’s prospects to artificially affect its share price,’ there is a troubling lack of clarity regarding who the major market participants are in this case and the degree to which their activities may be coordinated. With many of these traders “cloaked in anonymity, there is no way of knowing whether messages touting GameStop come from average Joes – or scam artists executing a ‘pump-and-dump’ stock scheme.”

In yet another reference to the impact of online communities on the price of GameStop stock, Warren questions whether posts in these communities violated the law.

“To what extent did online message boards, such those on Reddit, or broader social media amplification impact the fluctuation of GameStop’s prices?” Warren writes. “Did any of these practices violate existing securities laws?”

The letter does also ask a similar question of hedge funds: “To what extent did large investors, such as hedge funds like Melvin Capital Management, and their short positions impact the fluctuation of GameStop’s share prices? Did any of these practices violate existing securities laws?”

And the letter accuses both large and small investors of “treating the stock market like a casino.”

But outside of these questions and this accusation, there’s a clear disparity with the way hedge funds and the retail investors who are members of these online communities are described in the letter.

The only other references to hedge funds in Warren’s letter are in relation to the “substantial profits” they were set to reap and the activities in the market “forcing these hedge funds on the losing side of these trades to sell parts of their portfolios to raise cash to cover their losses.”

Retail investors and online communities, on the other hand, are described as a “flash mob with money” with Warren lamenting that members of these online communities are “cloaked in anonymity.”

And while Warren questions whether “investors may have profited from potential manipulation” in the letter, there’s no mention of the actions of stock trading apps such as Robinhood, which blocked millions of customers from buying these stocks just after their price had reached all-time highs. Some of these stocks tumbled by as much as 70% after customers were blocked from buying.

Warren’s calls for greater scrutiny of Reddit and online communities follow numerous mainstream media outlets pushing a similar narrative in recent days by amplifying claims that these online conversations could have been “an engineered misinformation campaign” and calls for regulators to “understand that manipulation is manipulation whether it’s happening through a new technology medium or it’s happening through traditional mail.”