Headlines across the globe see Australia making aggressive moves towards a cashless society, a move that gravely threatens the last bastions of economic privacy and individual autonomy. Are Australia’s major banks merely championing the cutting edge of financial convenience, or is there a more pernicious hidden agenda seeping into our digital economy? It certainly appears that Central Bank Digital Currencies (CBDCs), the potential beneficiaries of a cashless society, could become the shackles of a future technocratic authoritarian world.

Of note, two key issues have constantly shadowed the glittery promise of CBDCs. Stripped bare of the intricacies of digital finance, these issues are glaringly simple: a cashless society, necessary for CBDC proliferation, eradicates all scope for trade privacy. Consequently, a switch to this digital model hands unmitigated control over your personal funds to banks and government bodies.

In recent times, behind the distraction of the pandemic, Australia has conducted a year-long experiment navigating these uncertain digital waters. Engaging in pilot programs with formidable corporations such as Mastercard and working hand-in-glove with the Bank for International Settlements, it’s clear that the verdict on CBDCs is about to be pronounced by those in power.

Australia’s top four banks have advanced this agenda by expunging over-the-counter cash withdrawals from most branches. Elusive “special centers” touted to cater to “more complex banking needs including cash” merely serve as a smokescreen for this ominous trend of depreciating paper money.

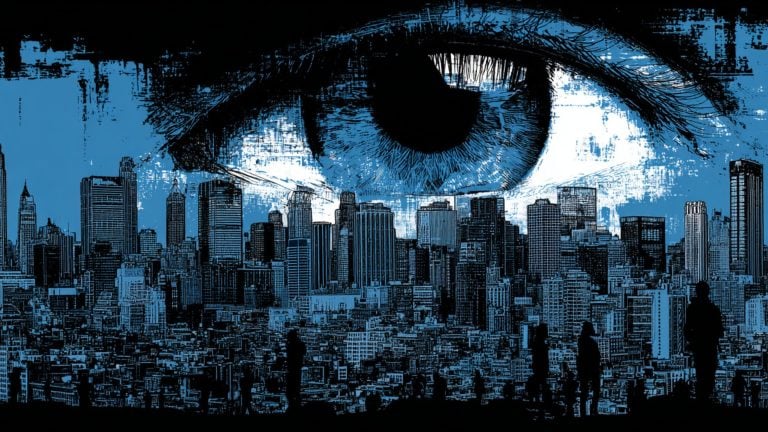

Yet the real sting in the tail lies in the unprecedented level of control CBDC implementation offers to the establishment. An intricate web of social engineering can be woven as the flow of money in society becomes tailored to specific interests.

The tyranny extends further. Consider a scenario where CBDCs have an expiration date, coercing consumers to accelerate their spending. Factor in the imposition of Chinese-style social credit scores creeping into the West, where unfavorable speech or belief systems incur financial penalties or account limitations.

Australia’s choice to pioneer the first wave of this cashless future is a clever strategic move from the establishment. Capitalizing on the efficient enforcement of severe lockdown measures, the government seems ready to leverage the compliant temperament of Australians to pilot this currency overhaul.