“Financial inclusion” seems to be the buzzword that proponents of digital IDs, payments, and data exchange have picked for their PR sloganeering in favor of something that is, objectively, very controversial.

And where better to “test” something of that kind than among those who due to their economic circumstances don’t have much of a say – like a number of African countries.

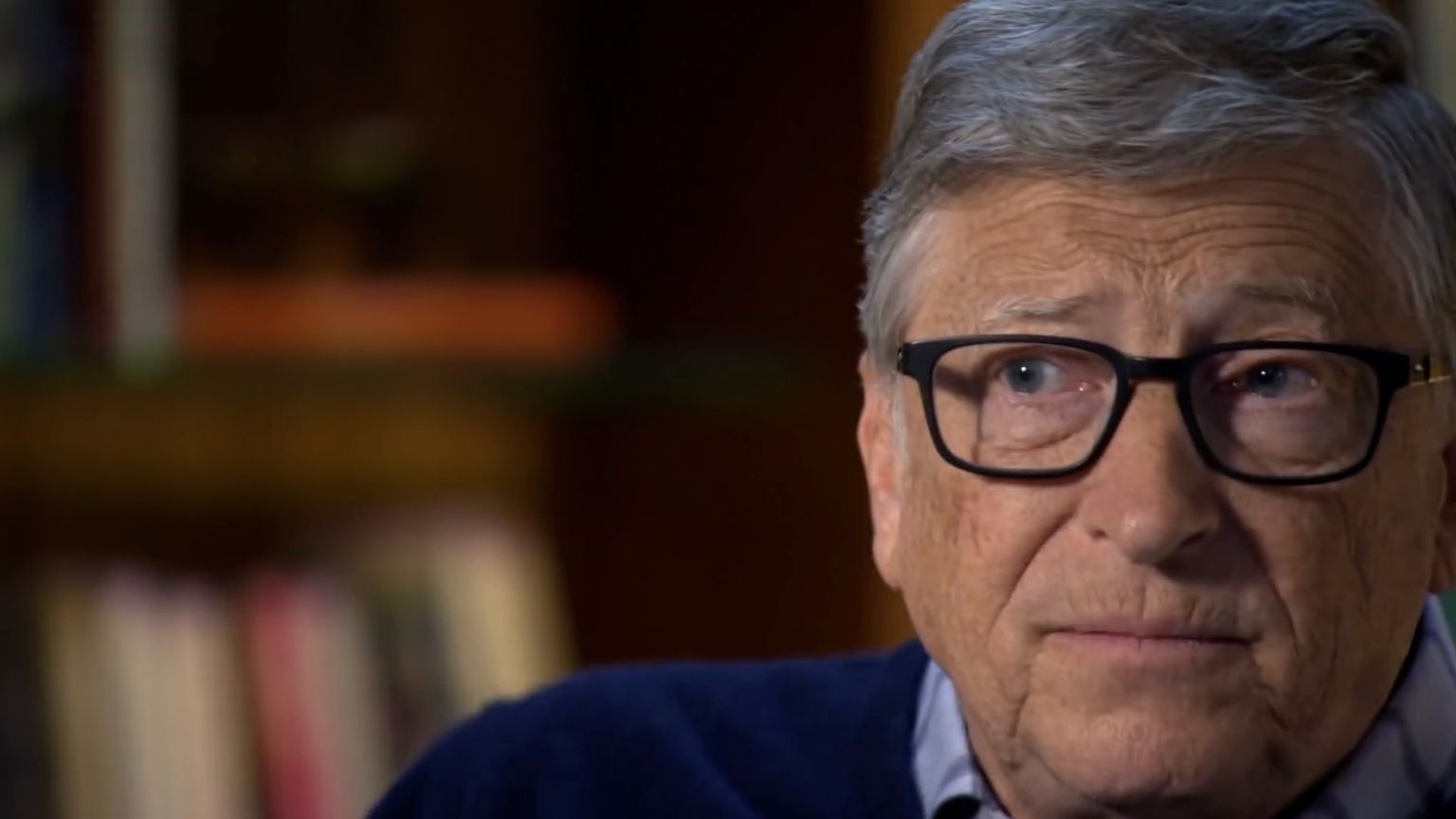

But don’t expect those behind the effort, juggernauts like Mastercard or the (Bill) Gates Foundation, to ever spell it out in those stark terms. After all, it’s genuine concern for other humans, equity, equality, and kindness that’s been behind the billions, if not trillions of dollars they have amassed thus far, right?

Clearly not.

Reclaim Your Digital Freedom.

Get unfiltered coverage of surveillance, censorship, and the technology threatening your civil liberties.

But what are they up to now?

“Stakeholders” they call themselves – self-appointed though, and their goal – other than, ostensibly, to keep the “global south” in check – is to make sure that digital public infrastructure projects, “including digital IDs,” get as much traction as possible in developing countries (first).

Both Mastercard, and the Gates Foundation, are telling us this is part and parcel of their selfless global fight against poverty and other ills plaguing humankind.

Their resume, though, these last couple of years/decades, does speak for itself – specifically, otherwise.

Right now, Mastercard, that little person’s best friend /s, has come up with something called Community Pass. “Farm Pass” – apparently a “sub-project,” is another term being thrown around.

Reports say it’s “a platform for digital IDs aimed at individuals such as business owners and farmers.”

And wouldn’t you know it, it’s one that happens to focus on African countries.

There’s no lack of ambition here, of course: Mastercard wants to register 15 million people in Africa by 2027. And Asia-Pacific region should not rest on any independence or self-determination laurels, either. Mastercard is after you as well – the same number of people, by the same date, is the stated goal.

In Africa – Uganda, Kenya, Tanzania, Mauritania – 2.5 million people are said to be on board, and Ghana and Ethiopia might easily be next, as the global payments behemoth tests the levels of these farmers’ financial desperation.

Ostensibly – for testing comprehensive Digital IDs, for the whole world.

Are you excited? Michael Wiegand, director of Financial Services for the Poor at the Bill & Melinda Gates Foundation, suggests he is.

“It’s time for a new approach to financial inclusion (to) to move beyond basic banking services (…) One of the most exciting advancements in global development is the expansion of financial services.”

Enter “digital public infrastructure (DPI),” as per Wiegand.

“This concept (…) underpins inclusive financial systems. Foundational DPI is based on three core, interoperable components: digital identity (ID), payments and data exchange. In practice, this gives countries and people the ability to digitally verify identities, securely and instantly send and receive money, and safely exchange information.”

Tl;dr: Good luck to us all.