The World Economic Forum (WEF) has unequivocally endorsed the adoption and proliferation of Central Bank Digital Currencies (CBDCs) at the “Summer Davos” event this week.

The WEF showcased, through an array of discussions, the pivotal role of “public-private partnerships” in fashioning an integrated financial system.

As the members of the World Economic Forum (WEF) lift their champagne glasses in a toast to CBDCs, the alarm bells ring louder for the privacy and civil liberties of the common man.

The WEF, often described as an exclusive club of the world’s economic elites, has given its thumbs up to CBDCs, portraying them as the next financial evolution. But beneath the veil of this lies an insidious world where our privacy could be auctioned off to the highest bidder – the government.

CBDCs are essentially digital versions of national currencies, touted to bring about an efficient, secure, and accessible monetary system. However, the alarming aspect is the almost Orwellian control it could potentially hand over to central banks and governments. With digital currencies in place, the authorities can peer into your financial transactions with microscopic precision.

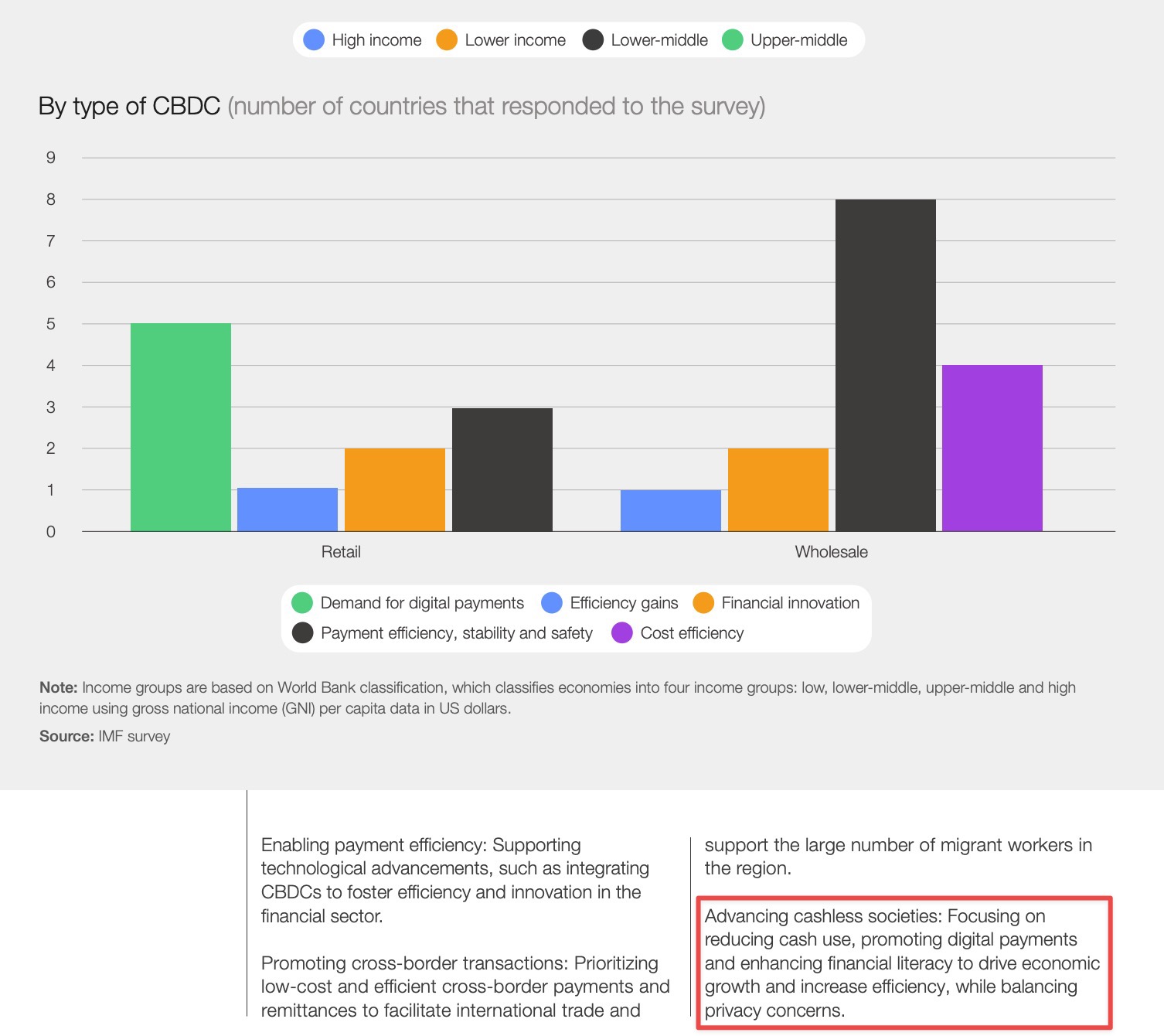

In a report, timed for release with the event this week, the WEF listed “advancing cashless societies” as one of the strong motivations for introducing CBDCs. “Focusing on reducing cash use, promoting digital payments and enhancing financial literacy to drive economic growth and increase efficiency, while balancing privacy concerns,” the report states.

Though it doesn’t say exactly how “balancing privacy concerns” will be addressed.

The conference this week brought attention to the stark reality of physical money becoming a relic, as Eswar Prasad, a Cornell University professor, emphasized during his speech.

Prasad enlightened the audience on the duality of CBDCs. He marveled at their potential benefits but also cautioned against the possible perils. One of the intriguing aspects of CBDCs, according to him, is their programmability. Governments could engineer these digital currencies with the ability to expire and to dictate what they can or cannot be used for.

“We are at the cusp of physical currency essentially disappearing,” said Prasad, thereby underlining the gravity of the situation.

Imagine a world where your money has an expiration date or is tailored to permit the purchase of certain goods while explicitly prohibiting others. Prasad expressed his concerns by saying, “You could have a potentially … darker world where the government decides that units of central bank money can be used to purchase some things, but not other things that it deems less desirable like say ammunition, or drugs, or pornography, or something of the sort.”

He warned that this level of control could be a double-edged sword, with the government’s ability to guide economic and social policies through currency itself. The integrity and independence of central banks could be severely undermined if digital currency is manipulated in such a way.