EU finance ministers have signed off on a roadmap that could pave the way for a digital euro, outlining how caps on individual holdings would be introduced, without setting those limits just yet.

The decision, made during a Eurogroup meeting in Copenhagen, edges the European Central Bank closer to launching its own digital currency, even as skepticism grows over how the system could affect personal financial freedom.

Rather than settling on specific numbers, ministers agreed on a timetable and institutional process for introducing holding limits.

A senior official at the press conference emphasized that the discussion focused on the how, not the how much.

That distinction comes at a moment when digital currency plans are drawing increased scrutiny across Europe and beyond.

In the UK, central bank proposals to limit stablecoin balances have already prompted warnings from digital asset advocates concerned about restricting financial choice.

The holding cap issue has been a persistent source of disagreement among EU institutions.

The ECB’s own report at the end of 2024 pointed to this friction, and Politico later revealed growing tensions between the central bank and national counterparts, some of whom are uneasy about undermining traditional banking.

Still, the ECB is pressing forward. Board member Piero Cipollone has argued that the digital euro would be a reliable, privacy-protecting alternative to cash, particularly in emergencies. “The bank will not know anything about the payer and the payee,” he said earlier this month, insisting the offline version would match cash for confidentiality.

Even so, privacy defenders are unconvinced. The very architecture of a centrally issued digital currency raises red flags, especially if access is limited or monitored under the guise of managing risk.

Offline or not, skeptics argue, there’s no guarantee anonymity will hold up once the system is live.

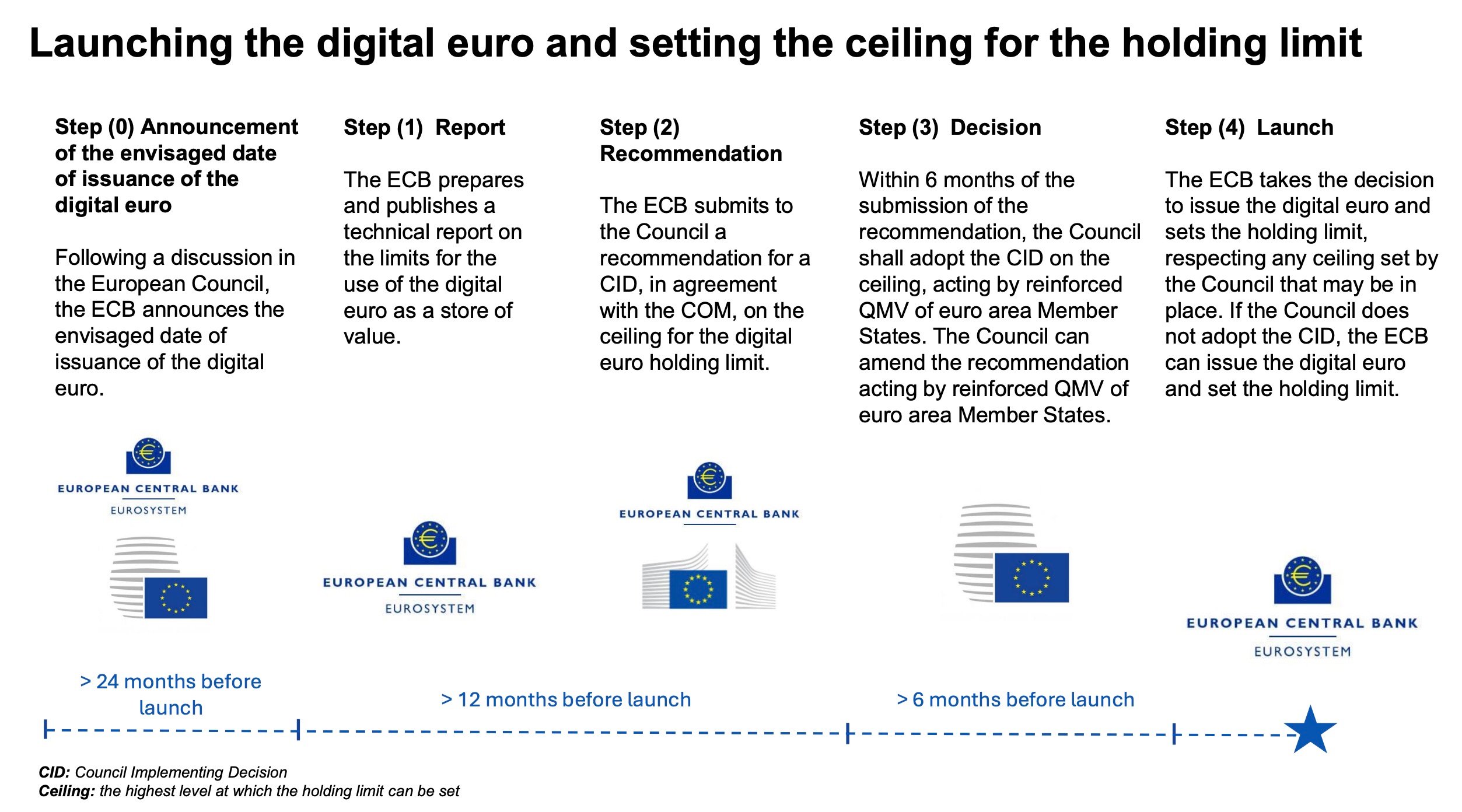

The framework adopted by the Eurogroup lays out a step-by-step process. If the ECB decides to go ahead, it must signal the intended launch at least two years in advance.

Between 12 and 6 months before rollout, the central bank would submit its proposed cap to the European Council. That body would have half a year to respond, after which the ECB would finalize both the decision to launch and the limit itself.

In a recent speech, European Commissioner Valdis Dombrovskis pointed to geopolitical instability as a reason to accelerate the project. “Recent developments in today’s more complex, conflictual world have also underlined the urgency of making progress on the introduction of the digital euro,” he said, adding that he hoped for “important progress” in the near term.

What remains unclear is how much public buy-in the project can earn. Privacy, access, and autonomy are still up in the air, and while officials continue to frame the digital euro as a safe, modern form of cash, not everyone is convinced the trade-offs are worth it.