In response to proposed IRS monitoring expansions, Nebraska has stated that it will “not comply.”

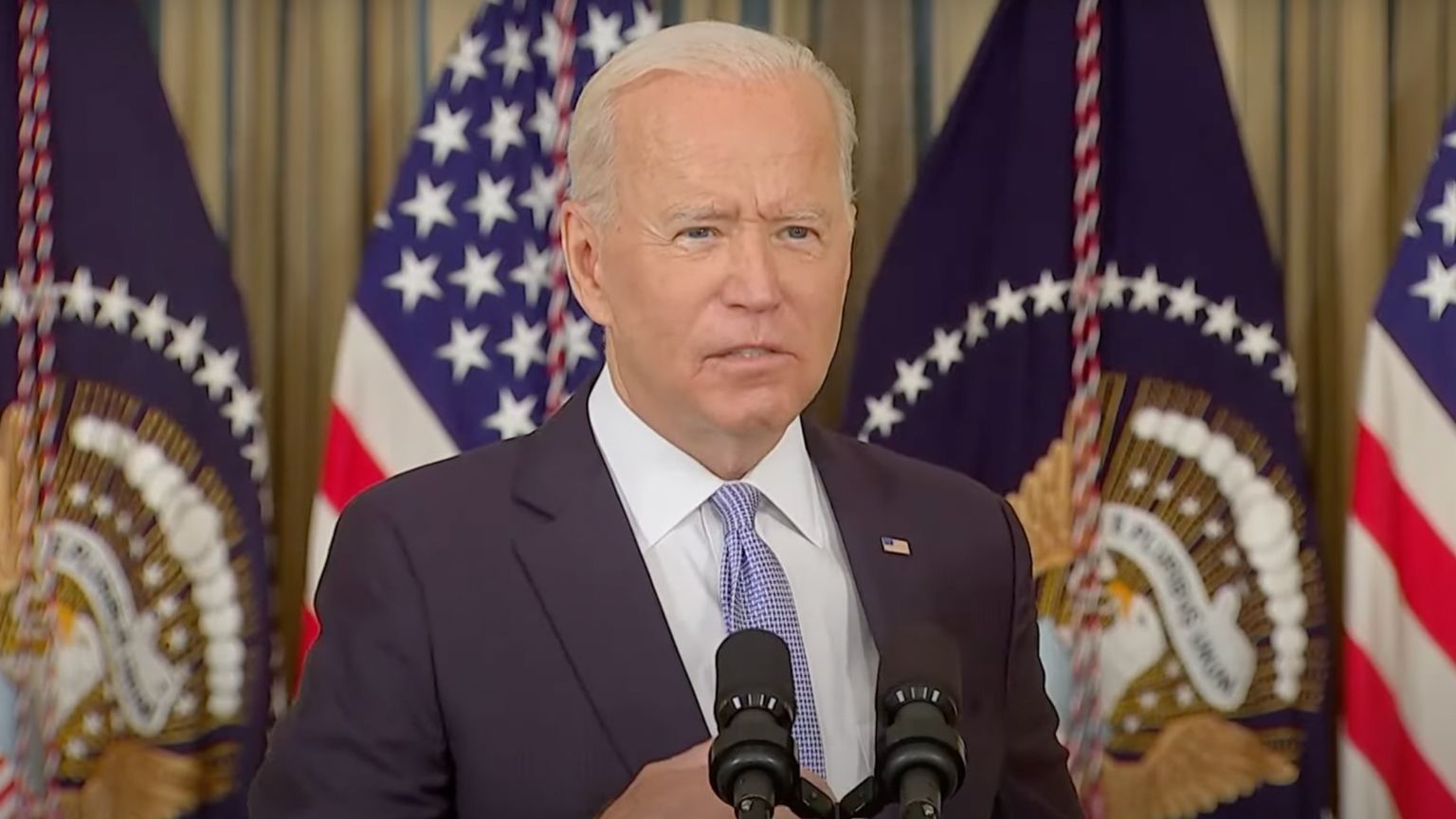

A proposal allowing the Internal Revenue Service (IRS) to monitor Americans’ bank accounts is in President Biden’s $3.5 trillion budget plan. The addition would allow the IRS to compel banks to disclose all transactions of most bank accounts.

We explored the financial surveillance proposed in the bill here.

In response, the state of Nebraska has stated that it will “not comply” with the increased powers demanded by the IRS in the lengthy budget reconciliation bill. Nebraska State Treasurer John Murante said his state is spearheading the opposition to the proposal that would require banks to report accounts with at least $600 in transactions to the Internal Revenue Service.

In an interview with Fox Business, Murante stated that, “My message is really simple. The people of Nebraska entrusted me to protect the privacy of these accounts and I am not going to comply with this. If the Biden administration sues me, we will take it all the way to the Supreme Court. We are going to fight every step of the way.”

“If the Biden administration sues me, we will take it all the way to the Supreme Court,” he added.

Nebraska is the first state to come out against the president’s plan. Murante expects that additional states will follow suit and reject the proposal, as he told Fox News’ Maria Bartiromo that, “we have members across the country who are committed to limited government and free market approaches, and we are unanimously against this proposal. It is an invasion of privacy and lacks any due process.”

In an official statement released last month, Murante claimed that, “This could lead to a tremendous invasion of privacy the likes of which our country has never seen. Millions of law-abiding Americans would suddenly have their bank accounts opened to federal investigators for no more reason than buying a refrigerator. This is simply unconscionable. To make matters worse, under this proposal, saving for college could put an American family on the IRS’s radar, costs that most likely will be passed on to the public.”