Coinbase CEO Brian Armstrong has joined the growing wave of opposition to a new Senate Democrat proposal aimed at tightening federal control over decentralized finance.

The draft legislation would give the Treasury Department expanded authority to target DeFi protocols and extend Know Your Customer rules to a broad range of non-custodial interfaces and wallet developers.

If adopted, the Senate Democrats’ proposal would have profound implications for financial privacy in the United States.

By attempting to impose Know Your Customer rules on DeFi frontends and non-custodial wallets, the legislation would effectively strip users of the ability to transact anonymously or pseudonymously on open financial networks.

More: US Treasury Weighs Digital ID Verification in DeFi Under GENIUS Act

These tools allow individuals to maintain sovereignty over their funds without relying on centralized intermediaries.

Subjecting them to surveillance mandates would mean forcing developers and interface operators to collect personal data they were never designed to access or store, an impossible task in many cases and a clear threat to user anonymity.

The broader consequence is a chilling effect on privacy-focused innovation.

Developers who build permissionless tools that enable self-custody and decentralized access could face legal exposure simply for contributing to open-source code or maintaining user interfaces.

This would not only discourage US-based development but could also erode protections for individuals seeking alternatives to traditional financial surveillance systems. Rather than targeting criminal activity narrowly, the proposal sets a precedent for blanket financial monitoring that treats all users as potential suspects.

For privacy advocates, this is a direct challenge to the right to private, censorship-resistant economic participation.

More: An Introduction to Decentralized Finance

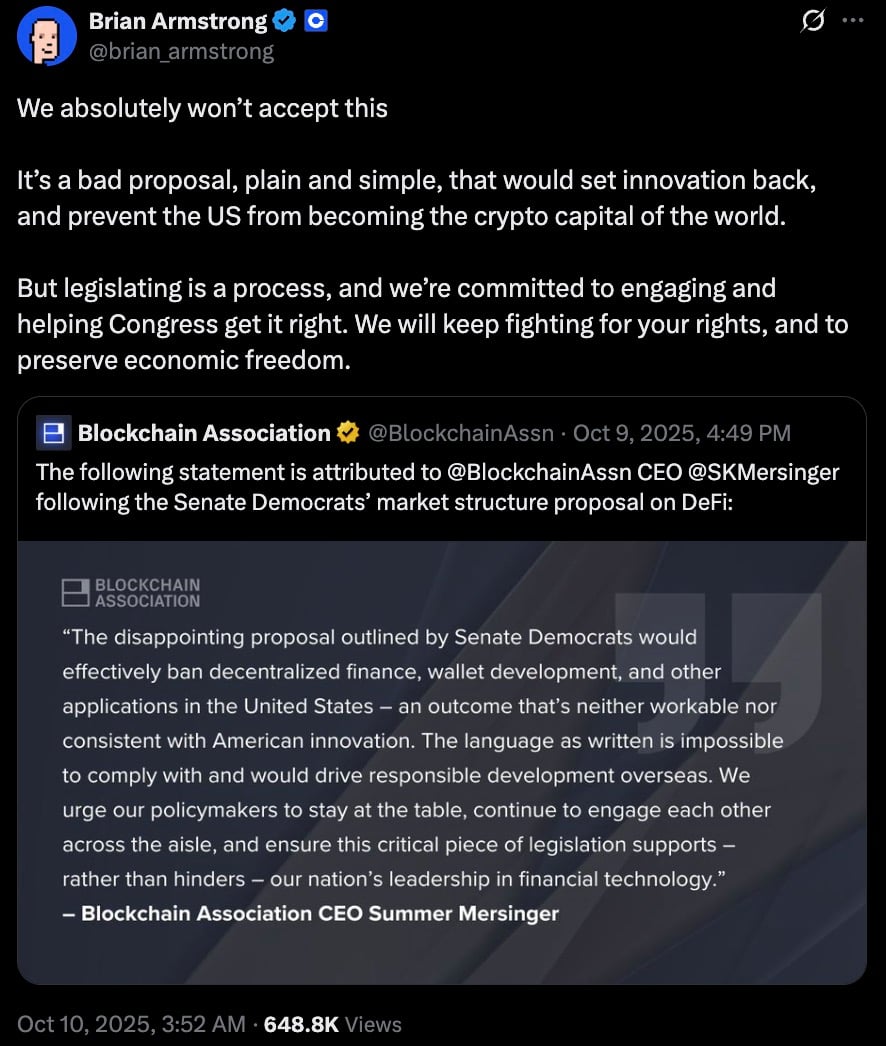

Armstrong, in a post on X, was clear in his rejection. “We absolutely won’t accept this,” he wrote.

“It’s a bad proposal, plain and simple, that would set innovation back, and prevent the US from becoming the crypto capital of the world.” While criticizing the substance of the proposal, he emphasized the importance of ongoing engagement in the legislative process.

“But legislating is a process, and we’re committed to engaging and helping Congress get it right. We will keep fighting for your rights and to preserve economic freedom.”

The plan, introduced by Democrats on the Senate Banking Committee, would classify those who design, operate, or financially benefit from DeFi frontends as intermediaries.

It would also allow regulators to determine whether a protocol is “sufficiently decentralized” and assign compliance obligations accordingly.

The proposal lands as talks on crypto market structure continue across both chambers of Congress.

While the House passed a related bill in July with strong bipartisan backing, the Senate has yet to reach consensus on its version. The Agriculture Committee, which oversees the Commodity Futures Trading Commission, has not introduced its draft.