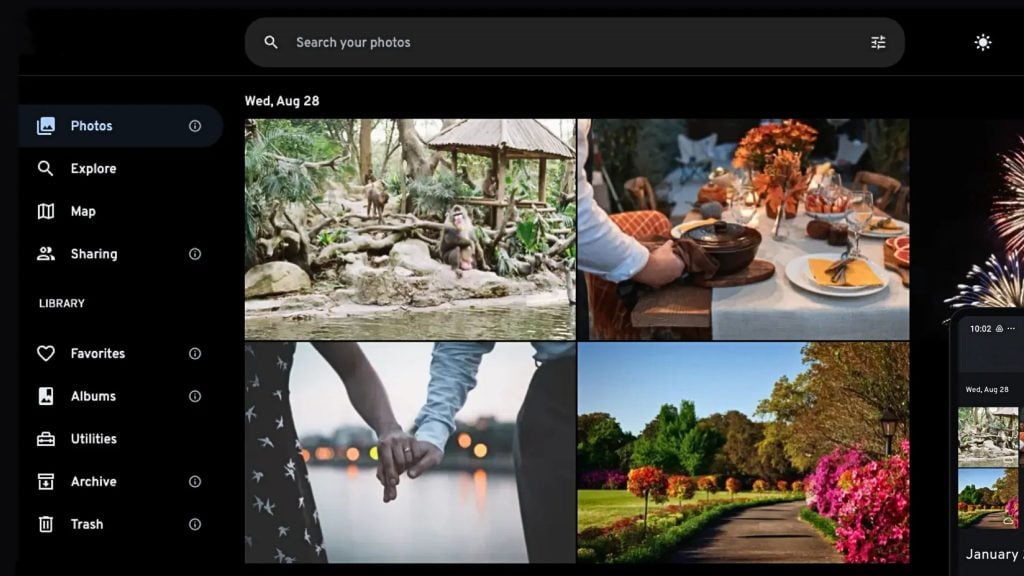

Federal Reserve Chairman Jerome Powell pledged on Tuesday to revise language in a Fed manual that instructs reserve bank officials to consider whether a financial institution’s leadership engages in “controversial commentary or activities” when reviewing applications for payment system access.

This provision, highlighted by Senator Cynthia Lummis during a recent hearing, has drawn criticism from the Wyoming Republican, who argues that the Fed is unfairly limiting certain institutions’ access to banking services. The debate over “debanking”—the exclusion of individuals and businesses from the financial system—has gained traction, particularly within the cryptocurrency sector.

Addressing concerns raised by the Senate Banking Committee, Powell acknowledged growing reports of debanking incidents and expressed unease over the trend. “I too, am troubled by the quantity of these reports,” Powell stated in his testimony before the committee. He suggested that some banks might be erring on the side of caution, reluctant to engage with customers whose activities could raise compliance risks, particularly concerning anti-money laundering regulations. “One theory is that banks are just very risk averse,” he noted.

A section of the Fed manual states that reserve bank officials should evaluate the conduct of financial institutions and their leadership to determine whether affiliation with them presents “undue reputational risk.” It also asks whether an institution’s leadership is linked to “controversial commentary or activities.” However, the manual does not define what qualifies as “controversial commentary.”

During his testimony, Powell remarked that he and his colleagues were “struck” by the increasing number of cases in which individuals reported being excluded from the financial system. He assured lawmakers that the Fed was “determined to take a fresh look” at the matter.

The issue of debanking took center stage at a Senate Banking Committee hearing last week and has also been referenced by former President Donald Trump, who addressed it in January. However, the Fed has declined to comment on whether this specific manual guidance has directly led to financial institutions being denied access to a Fed master account.

Senate Banking Committee Chair Tim Scott pressed Powell on the subject, particularly regarding the use of “reputational risk” as a basis for political considerations in banking decisions. Scott asked whether Powell would commit to eliminating reputational risk as a factor in policy decisions.

“I’m happy to make that commitment,” Powell responded.

Following the hearing, Lummis was critical of Powell’s stance. “Chair Powell wants to be praised both for acknowledging the Fed’s Account Access Implementation Handbook actually exists, and for excluding policies that give the Fed the ability to censor speech,” she stated in an email. “However, making a change because you got caught is hardly taking accountability.”