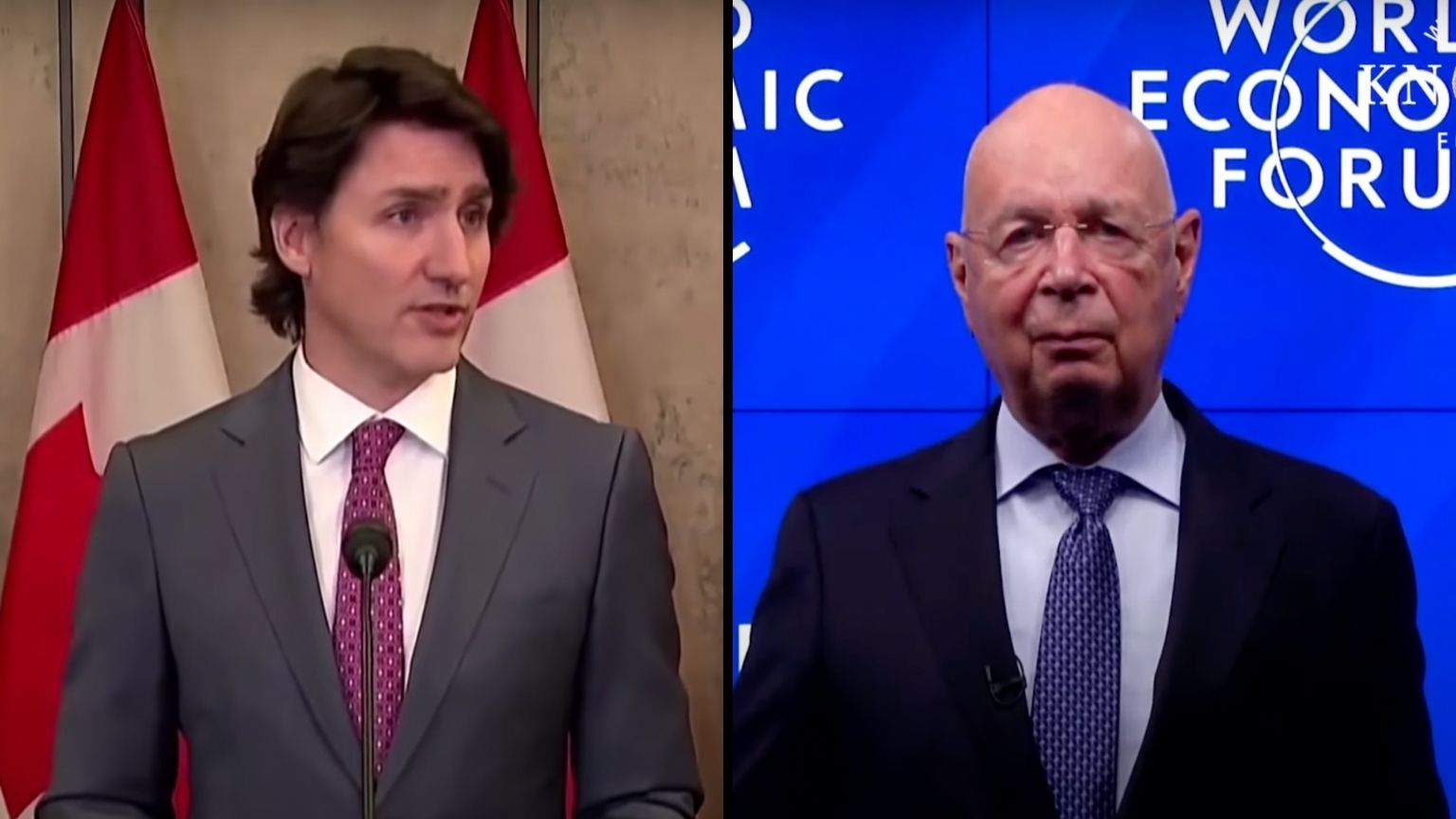

As Canada’s digital ID plans move closer, the Canadian Banking Association (CBA) is pushing for a national digital identification system. In a recent whitepaper, the World Economic Forum also argued for dystopian-sounding digital IDs, which could be used to decide who gets access to services, adding that banks should lead the way.

Plastic cards and paper licenses are an outdated technology that should be replaced with a digital identification system, says president and CEO of the Canadian Bankers Association, Neil Parmenter.

The CBA published a white paper in 2018 titled “Canada’s Digital ID Future – A Federated Approach,” where it outlined how Canada can transition from the current system to a digital identification system.

The white paper claims: “The advantages to the federated digital ID system are clear for Canada. Unlike a centralized identity framework that puts the control of identity under one key player, a federated identity system leverages multiple systems, eliminating reliance on a single service provider. In other words, there is no single point of control or failure that can compromise the entire system. A federated model would also align with Canada’s federal structure by creating linkages between provincial and federal government identity management systems.”

A lot of information could be stored in someone’s digital ID, including biometric data, driver’s license, financial tools, and healthcare information. Other data that could be added include vaccine status, criminal record, credit score, and gun license status.

In its report, the World Economic Forum said that banks should spearhead digital identity projects.

“Canada’s strong financial institutions must play a key role. The World Economic Forum stated in its report financial institutions should champion efforts to build digital ID systems and lead the creation and implementation of identity platforms,” reads the white paper.

Parmenter reiterated that the WEF recommended financial institutions because they are “highly regulated and trusted.” He added that they have “advanced cybersecurity and privacy technology and they have the infrastructure to operate provincially and nationally.”

Canada was recently criticized for freezing the bank accounts of civil liberties supporters.